When it comes to your wealth, you’re likely very proud of everything you’ve built. You might have started to think about how much you’d like to leave to your loved ones when you pass away, ensuring that they can benefit from your life’s work, too.

Indeed, “giving while living” appears to be increasing in popularity. According to MoneyAge, one-third of baby boomers are planning to pass money to their adult children this year, leading to a potential wealth transfer of £12 billion.

While it is important to make sure you have enough money to live on yourself, gifting money to your loved ones before you pass away can be beneficial in more ways than one.

There are both emotional and financial advantages to gifting while you are still alive. So, here is why giving while living could be the right option for you.

1. You get the opportunity to see the joy your money brings

If you had to answer the question, “Why do you work so hard?”, what would you say?

You might answer that you love your job, but more often than not the first answer would be, “to provide for myself and my family.”

Indeed, it can be easy to lose track of why you have worked so hard to accumulate your wealth in the first place. Of course, you can leave your wealth to your family when you pass away, but giving while living could present an added benefit: you get to see the joy your money brings.

By gifting your family their inheritance while you are living, you could reap the emotional rewards of your hard work.

2. Your loved ones will be able to benefit from their inheritance at a formative age

Not only might you benefit from seeing the opportunities your money creates, but your loved ones will gain something, too.

Gifting money to your children while they are at a formative age could be a powerful act. As young adults, your children might be:

- Attending school and university

- Starting at the bottom of the career ladder

- Travelling the world

- Buying their first home

- Getting married

- Having children.

All these milestones are important rites of passage for many people – but they also cost a lot of money. Your children’s lives could be positively affected by receiving a part of their inheritance during these formative years, rather than receiving a lump sum when you pass away.

If you wait until you die, your children could be in their 50s and 60s – a time when an inheritance may be less useful to them.

By providing a foundation for your children to thrive in their young adulthood, your hard-earned wealth could have a bigger, more meaningful impact on those you love most.

3. Reducing your wealth over time could mitigate the amount of Inheritance Tax your estate pays

Not only are there amazing life benefits to giving while living, but reducing your wealth over time could also help reduce the Inheritance Tax (IHT) liability you leave behind.

As of the 2022/23 tax year, when you pass away, your estate would usually pay 40% IHT on:

- Wealth that exceeds £325,000 (called the “nil-rate band”)

- Property valued at more than £175,000 you pass to children or grandchildren (the “residence nil-rate band”).

In the 2021 Budget, the chancellor announced that the nil-rate bands will be frozen until 2026. In light of these freezes, it could be beneficial to give while you are alive, to reduce the value of your estate, and so lessen the IHT your beneficiaries will pay.

You can gift up to £3,000 a year tax-free, split any way you like among your beneficiaries, using your annual exemption. Any sum exceeding £3,000 could be subject to IHT if you were to pass away fewer than seven years after the gift is paid.

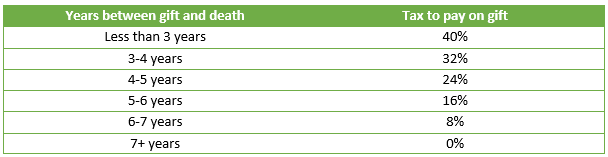

This is known as the “seven-year taper”, and as of the 2022/23 tax year, it is applied according to the below table.

Source: HMRC

Remember, taper relief only applies to gifts above the nil-rate band. It follows that, if no tax is payable on the transfer because it does not exceed the nil-rate band (after cumulation), there can be no relief.

Taper relief does not reduce the value transferred; it reduces the tax payable as a consequence of that transfer.

It is important to note that you should only gift what you can afford to lose now, so it may be constructive to review your gifting options with a financial planner.

How Lloyd O’Sullivan can help you manage your estate tax-efficiently

Giving while living is a big decision that you don’t have to make alone.

At Lloyd O’Sullivan, your financial planner can offer a review of your financial circumstances and explore gifting options with you and your loved ones. Your planner can also help you navigate IHT rules and plan for the future.

If you need guidance on giving while living, or on any other financial matter, get in touch. Contact us today by email at info@lloydosullivan.co.uk or by calling 020 8941 9779.

Please note

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Production

Production