After a challenging 18 months, the UK economy continues its slow recovery in the face of low interest rates and rising inflation.

For some, the end of the “furlough” scheme will mean continued financial pressure, while for others, the days of “accidental” lockdown savings are long gone too.

However the pandemic has affected your finances, as life resettles into a new normal – and with both Christmas and tax year end on the horizon – it is important to take stock of your finances.

Here are five ways to get financially shipshape this autumn.

1. Set a budget

Creating a budget is a useful way of ensuring you’re living within your means.

First, add up all your monthly expenses. Then subtract this figure from your take-home pay.

If you’re overspending, go through your expenses to see if you can make any cutbacks. This could be as simple as cancelling unused subscriptions or checking whether you can switch to a cheaper energy deal.

If you have spare money each month, try putting some towards savings. It’s generally a good idea to save three to six months’ worth of expenses as a rainy day fund, so you can pay for unexpected emergencies.

2. Consider investing in the stock market

Once you’ve built up an emergency fund, you could consider investing spare money in the stock market.

The stock market exposes you to investment risk, so there’s a chance your fund could fall as well as rise. However, history shows that, over time, money invested in the stock market tends to grow faster than money held in cash, especially in the current climate of historically low interest rates and rising inflation.

Data from MoneySavingExpert shows the highest return on a three-year fixed-rate savings account is around 1.25%.

In contrast, research from IG shows the FTSE 100 produced an annualised return of 7.75% between 1984 and 2019. This period included major stock market declines, such as the dot-com bubble, the start of the Iraq War, and the global financial crisis of 2007/08.

Whether or not investing is right for you will depend on what your financial goals are. If your goal is short term, such as buying a house in two years, then investing in the stock market generally isn’t wise. There’s a risk your investments could drop in value just before you need to access your money.

For longer-term goals, like saving for retirement, investing will allow your money to benefit from stock market growth. However, you must be comfortable with investment risk. If you’re unsure, speak to us.

3. Top up your pension

If your savings increased during the pandemic, consider topping up your pension.

It’s a good idea to increase your pension contributions each time you get a pay rise, to avoid frittering away the money on everyday expenditure.

Investing in a pension is a great way of boosting your future financial resilience. Each time you pay into a pension, the government adds 20% tax relief. Higher- and additional-rate taxpayers can claim a further 20% and 25%, respectively.

The sooner you start investing in a pension, the more you’ll get in tax relief and the more time there will be for investment growth.

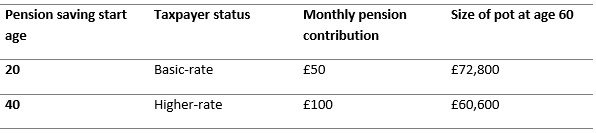

The table below shows that someone who delays paying into a pension until age 40 could end up with a pension that’s far smaller than if they started at age 20, even if their monthly contributions are higher and they qualify for a higher rate of tax relief. The figures assume annual investment growth of 4%.

Source: Unbiased

4. Find out when your current mortgage deal ends

When your mortgage deal comes to an end, your lender will most likely move you onto their standard variable rate (SVR). This could cost you significantly more money.

Figures from Moneyfacts show the average SVR is 4.44% as of August 2020. This compares with an average rate of 2.54% for fixed-rate deals with a fee and 2.71% for fixed-rate deals without a fee.

If you have a £200,000 mortgage with 15 years remaining, moving to your lender’s SVR could cost between £178 and £195 more every month, according to the Which? mortgage repayment calculator.

If your deal has come to an end or will do shortly, switching to a new deal will ensure you don’t pay more than you have to. A financial adviser or mortgage broker can search the market for the right deal for you.

5. Review your protection needs

Taking out protection can give you the peace of mind that unexpected events won’t cause you or your family financial hardship.

Here are the main types of protection to consider:

- Life insurance, which pays your loved ones a lump sum if you die during the policy term

- Critical Illness Cover, which pays a lump sum if you’re diagnosed with a very serious illness

- Income Protection, which provides you with a monthly payout if you can’t work because of ill-health or injury.

Even if you already have protection, it’s worth checking whether it still meets your needs. If you’ve increased your mortgage, received a pay rise, changed jobs, or had a child, your requirements may have changed.

It’s also important to draw up a will or, if you already have one, make sure it still reflects your wishes. Writing a will ensures your assets end up in the right hands when you die.

Get in touch

If you’d like advice on investing, pensions, mortgages, or protection, or just want some general information about managing your money, please get in touch. Email info@lloydosullivan.co.uk or call 020 8941 9779.

Please don’t hesitate to share this article with your friends and family, or anyone else who you think might benefit.

Please note:

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The value of your investments (and any income from them) can go down as well as up, which would have an impact on the level of pension benefits available.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Production

Production