Last year was worrying for many investors as volatile global markets, fuelled by political and economic unrest, bounced up and down.

It was a particularly tricky period influenced by high inflation, rising interest rates, and the underperformance of traditionally secure assets.

Despite the doom and gloom, there are plenty of positive lessons to take from the events of 2022, and reasons to be hopeful about 2023.

Read on to discover three wonderful reasons to be upbeat this year, despite any ongoing investment worries.

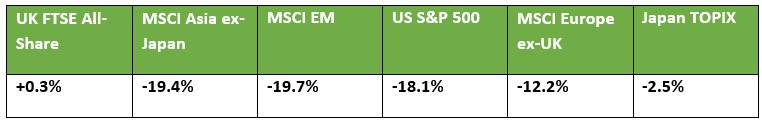

The majority of the world’s leading stock indices posted annual losses in 2022

Macroeconomic factors such as the pandemic, war in Ukraine, and the global energy crisis, caused issues for companies around the world in 2022. The vast majority of the world’s major stock indices posted annual losses for the year to the end of December 2022, as shown by the table below:

Source: JP Morgan

It is clear that stock markets were especially turbulent, and this can naturally prompt concerns.

However, there is a silver lining in the data. If you look at the UK’s FTSE All-Share’s performance in 2022, it reported marginally positive returns for the year. This was despite the greater UK economy struggling.

1. Short-term market downturns can provide potential investing opportunities

Market downturns can be concerning, but they could also present exciting new opportunities.

Traditionally valuable and secure commodities and equities might be priced lower than usual and give you the chance to acquire a holding for a smaller outlay or expand upon your existing investment at a reduced cost.

According to interactive investor, it is one of many positive reasons why so many UK investors are feeling optimistic about 2023. There is a plethora of reasonably priced opportunities to expand existing portfolios through acquiring solid investments at lower than usual valuations — the UK market being referred to as a “bargain basement”.

If you have surplus funds available and are in a position to increase your investments, purchasing undervalued stocks could see you benefit considerably in the long term.

2. A diversified portfolio can insulate your investments and help you stay on course towards long-term growth

One of the main reasons to diversify your portfolio is to insulate your investments from short-term fluctuations by offsetting potential losses with gains elsewhere.

The performance of major markets in 2022 made it an unusually tricky year to navigate. interactive investor reports that only 3 out of 13 asset classes produced positive returns across the year.

There were polarising performances across different sectors. For example, UK bonds and the property market had especially difficult years, whereas commodities performed well, with soft commodities such as coffee and wheat, and hard commodities such as oil and gold producing positive returns.

The currency market saw a similar swing in outcomes with the US dollar thriving, while the pound endured a difficult year, in part due to the autumn’s “mini-Budget” announcement.

To put it simply, while there were losses in some sectors, there were also gains in others. So, an investing strategy built around a well-diversified portfolio might have seen any potential negative outcomes reduced, as gains could have mitigated possible losses.

3. Over the long term, markets typically recover and eventually bounce back

Stock markets typically ebb and flow over the short term. However, when a wider perspective is taken, markets usually bounce back from dips and see positive growth over the long term. The past is no guarantee of future performance, but it does offer a reason to be optimistic.

Emotionally charged decisions can be detrimental to investors’ long-term plans. If you allow concerns in the short term to influence your investing decisions, you may opt to convert what was initially a paper loss into an actual one. This effectively removes any possibility of seeing your investment rebound if markets recover.

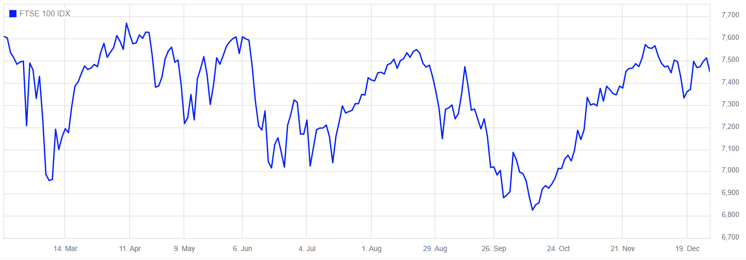

For example, if you look at the performance of the FTSE 100 throughout 2022 it swings up and down significantly.

Source: London Stock Exchange

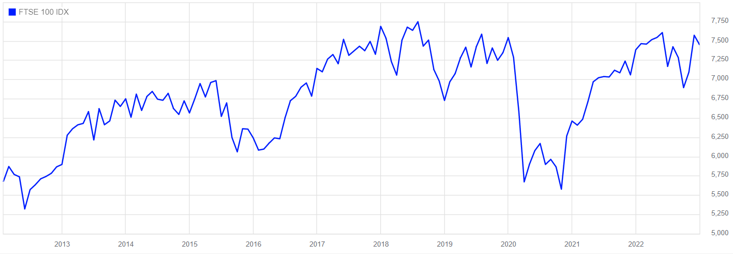

However, if you take a look at the bigger picture and review the market over a 10-year period, it becomes evident that despite short-term downturns, the market typically recovers and continues on an upwards trajectory.

Even when once in a lifetime events affect the market, such as the onset of the pandemic in early 2020, the passage of time will likely see the markets begin to rise once more.

Source: London Stock Exchange

Working with a financial planner can help alleviate you of any short-term worries and ensure you stay on course towards meeting your long-term goals.

Get in touch

The year is still young, but 2023 has already offered some uplifting news with inflation expected to have peaked and the FTSE 100 reaching new highs.

If you are struggling to shake off lingering concerns about your investments, you should reach out to us at info@lloydosullivan.co.uk or by calling 020 8941 9779 to discuss your best next steps.

Please note:

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production