An increase in your salary or business earnings is likely to be welcome news. It could allow you to spend more on the things you enjoy and help you build security for the future.

However, as your earnings rise, so too could your Income Tax bill.

Indeed, the latest figures from HMRC have revealed that over 7 million UK adults are expected to pay higher-rate Income Tax in 2025/26. This is a 38.7% increase compared to 2022/23. Moreover, 1.23 million people are projected to fall into the additional-rate Income Tax band in 2025/26.

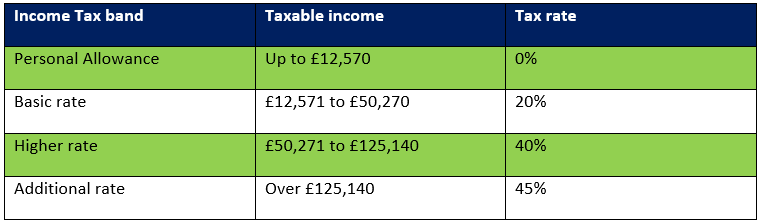

If you enter a higher Income Tax band, you could pay between 40% and 45% on eligible earnings, as shown in the table below. This could mean that your bumper pay rise or business earnings leave you with less in the bank than you hoped for.

Source: gov.uk

If you expect to move into a higher Income Tax bracket this year, keep reading to learn four clever strategies for staying as tax-efficient as possible, so that you can enjoy more of your wealth.

1. Boost your pension contributions

Pension contributions qualify for tax relief at your marginal rate. So, if you’re a basic-rate taxpayer, you’ll automatically receive 20% tax relief on your monthly contributions.

If you move into the higher-rate or additional-rate Income Tax bracket, you could claim an additional 20% or 25% respectively, via your self-assessment tax return.

As such, increasing your pension contributions may be an effective way to boost your tax-efficient retirement savings. Moreover, it could allow you to keep your earnings below the thresholds for higher- and additional-rate Income Tax.

This strategy might be particularly valuable if your income exceeds £100,000. Once you start earning more than this, your Personal Allowance – the amount you can earn before paying Income Tax – tapers by £1 for every £2 you earn above this pay threshold.

As a result, you could be at risk of falling into an expensive tax trap that means you pay an effective rate of 60% Income Tax on your earnings between £100,000 and £125,140.

In contrast, paying more into your pension each month could help you to:

- Keep your income below £100,000

- Preserve your Personal Allowance

- Reduce your Income Tax liability.

You’ll also have the satisfaction of seeing your pension pot grow, which may provide peace of mind about your long-term financial security.

However, it’s important to remember that a pension is a long-term investment that could go up or down over time.

2. Combine tax allowances as a couple

Money remains a taboo topic in many households, and you might feel uncomfortable talking about financial matters, such as a change in your income, with your spouse or partner.

Yet, if you’re in a relationship, managing your finances as a couple rather than individually could offer several tax benefits.

For example, by combining your individual Capital Gains Tax (CGT) Annual Exempt Amounts (£3,000 each in 2025/26), you could potentially realise up to £6,000 in gains as a couple without paying CGT.

Additionally, if your spouse or civil partner is in a lower tax bracket than you, transferring any taxable savings to them might allow you to reduce your shared Income Tax bill.

This is because your Personal Savings Allowance – the amount of interest on savings you can earn before tax is due – is calculated based on your marginal rate. Higher-rate taxpayers can only earn £500 interest on savings without incurring Income Tax, and additional-rate taxpayers have no Personal Savings Allowance at all.

In contrast, if your spouse or partner is a basic-rate taxpayer, they could earn up to £1,000 interest on savings without an Income Tax liability. If their total income is less than £12,570, they usually won’t pay any tax on savings interest.

Read more: 4 wonderful benefits of planning your finances as a couple

3. Make the most of your annual ISA allowance

Maximising your tax-efficient savings could help to offset any increase in your Income Tax liabilities.

In the 2025/26 tax year, you can contribute up to £20,000 across your ISA accounts, and any interest in returns you earn are free from Income Tax and Capital Gains Tax. Moreover, any withdrawals you make won’t count towards your taxable income.

As such, ISAs could provide a valuable tax planning tool.

Remember too that if you’re in a couple, both you and your partner have an individual ISA allowance of £20,000 each year. This resets at the start of each new tax year (6 April), and if you don’t use it, you lose it.

So, if you’ve used your full allowance and your partner is unlikely to use all of theirs, it might be worth topping up their ISAs. Additionally, if you have children, you could open a Junior ISA and contribute up to £9,000 (2025/26) a year tax-efficiently – this does not affect your personal ISA allowance.

4. Seek financial advice

If your circumstances change in any way, such as a pay increase, it’s a good idea to revisit your financial plan and ensure that it still aligns with your current situation, needs, and goals.

A financial professional can help you make the most of your higher income and create a tailored plan to ensure you’re managing your wealth as tax-efficiently as possible.

Through regular reviews, they can keep you up to date with any changes in tax rules and support you in keeping your tax liability as low as possible. This could allow you to take control of your wealth and free up more of your money to do the things that are most important to you.

Get in touch

If you expect to move into a higher Income Tax bracket this year, we can help you keep your wealth as tax-efficient as possible.

Please get in touch by emailing info@lloydosullivan.co.uk or call 020 8941 9779 to see how we can assist you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The Financial Conduct Authority does not regulate tax planning.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production