During your working life, you might have contributed a regular percentage of your salary each month toward building a healthy pension pot.

What’s more, your pension could be one of the most important sources of income you have in retirement.

Yet, research by The People’s Partnership has revealed that nearly a fifth of savers have never checked how much is in their pension.

So, if you’ve yet to engage with your pension or you’re uncertain about how to make the most of your savings, now is the ideal time to learn more.

Indeed, Pension Geeks’ 11th Pension Awareness campaign runs from 9-13 September. This week is designed to raise awareness of pensions and help people understand how they work.

Read on to discover four lesser-known pension facts that could help you make the most of your pension savings.

1. You can contribute to someone else’s pension

According to research published by Money Marketing, more than three-quarters of people are unaware they can contribute to someone else’s pension. Upon learning of this opportunity, more than half of this group said they wouldn’t consider making any third-party contributions.

In fact, there could be many reasons why you might want to top up someone else’s pension. For example, if your partner is taking a career break to care for your children or elderly relatives, they might not be able to keep up with their pension contributions. So, by paying into their pot, you can ensure they have sufficient savings in later life.

Indeed, third-party contributions can be a valuable financial planning tool.

However, the Annual Allowance limits the total contributions that can be made to an individual’s pension in a single tax year without incurring an additional tax charge. This stands at £60,000 for the 2024/25 tax year or 100% of an individual’s earnings, whichever is lower. If the pension owner’s income exceeds certain thresholds or they have already flexibly accessed their pension, their Annual Allowance may be lower.

If you are a higher earner and have used your Annual Allowance for the current tax year, contributing to your partner’s pension could be a useful way to maximise your pension savings as a couple.

It’s important to note that the amount you can contribute to someone else’s pension each year depends on the circumstances of the pension owner – rather than yours.

So, you could contribute to the pension of a working person provided that the total contributions made to their pension in a single tax year do not exceed their Annual Allowance.

Also, tax relief is applied according to the pension holder’s marginal rate of Income Tax, not the contributors. This is automatically applied at the basic rate, and if the pension owner is a higher- or additional-rate taxpayer, they can claim back additional relief via their self-assessment tax return.

If you wish to pay into the pension of a non-working person, you can contribute up to £2,880 (2024/25), which equates to £3,600 once the government’s basic-rate tax relief has been added.

These allowances apply to children too. Even if they have no earnings, you and your wider family could contribute up to £2,880 to a pension for your child each tax year.

By paying into a pension from your child’s very early years, the compound interest and government tax relief could accumulate over many years, and this wealth may generate investment returns too. So, this could be an effective way to provide for your child’s financial future.

2. Women typically have less in their pension pot than men

Figures published by Now: Pensions in partnership with the Pension Policy Institute, have revealed that by the time women reach age 67, they will have average pension savings of £69,000. This is £136,000 less than the average man, who will have saved £205,000 in the same period.

There are several reasons for this gender pension gap, such as the fact that women are more likely to take a break from paid employment to care for children and elderly relatives. The report also revealed that women make up 79% of employees who earn less than the threshold for automatic enrolment in a workplace pension.

Fortunately, there are ways that women can bridge the gender pension gap. Being aware of the situation is a crucial first step.

Women could also prepare for career breaks by increasing their pension contributions early in their careers. Alternatively, as discussed above, if a woman takes a step back from paid employment, their partner could contribute to their pension.

Finally, if a woman gets divorced, ensuring that their financial settlement includes a pension sharing arrangement in which pension savings are equally divided or accounted for might help them keep their retirement plans on track.

3. A pension could be used to reduce Income Tax liability

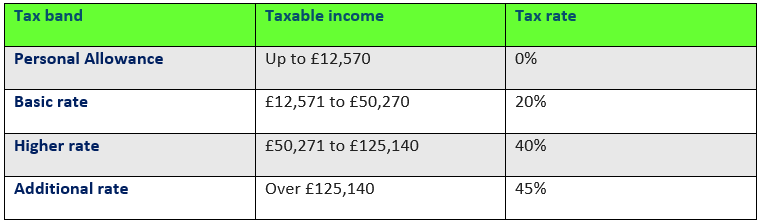

Usually, the amount of Income Tax you pay depends on how much of your annual income exceeds your Personal Allowance – for most people, this is £12,570 (2024/25).

The table below shows the different Income Tax bands in 2024/25 (these are different if you live in Scotland).

Fortunately, if you’re a higher- or additional-rate taxpayer, you may be able to reduce your Income Tax liability using “salary sacrifice”.

This is a scheme offered by some employers that allows you to reduce your salary in return for another benefit – including making more tax-efficient pension contributions.

Salary sacrifice allows you to reduce your pre-tax salary by the amount of additional pension contributions you want to make, and your employer will pay this amount into your pension.

For example, if you reduce your salary by £5,000 per year via salary sacrifice, instead of your pension contributions being deducted at source, your employer will pay this amount into your pension.

As you’re effectively earning a lower salary, you could fall into a lower tax band. What’s more, both you and your employer might pay less in National Insurance contributions (NICs), so you could even see your take-home pay increase.

Despite these potential tax benefits, research by FTAdviser has shown that a fifth of UK workers have never heard of salary sacrifice.

While salary sacrifice may seem appealing, it’s worth seeking professional financial advice before forging ahead, as a lower take-home salary could affect your wider financial plans. For example, it might limit how much you can borrow as a mortgage. Additionally, if you used it to move into a lower tax band, you may receive less in tax relief on your pension contributions.

4. The “carry forward” rule could allow more tax-efficient contributions in a single tax year

As explained above, the Annual Allowance sets a maximum amount for how much you can contribute to your pensions tax-efficiently.

However, you might not be aware that you can “carry forward” any unused allowance from the previous three tax years.

This could be especially useful if you receive an unexpected windfall, such as an inheritance, and you decide to use some of this to top up your pension.

Imagine you had earnings of £60,000 in 2023/24 and could make use of the full Annual Allowance. If your total pension contributions (including employer and third-party contributions and government tax relief) were only £50,000, you could carry forward your unused £10,000 to the 2024/25 tax year.

Assuming your earnings for the current tax year remain the same, this would allow you to contribute up to £70,000 to your pension tax-efficiently in a single tax year.

It’s important to note that if you’ve triggered the Money Purchase Annual Allowance by drawing flexibly from your pension, you can’t use carry forward to boost your allowance for the current tax year.

Get in touch

Understanding your pensions and how they work is crucial if you want to accumulate wealth as tax-efficiently as possible. A financial planner can also help you plan how to draw a sustainable income from your pension.

If you’d like to learn more about your pension and create a strategy for funding the retirement lifestyle of your dreams, we can help.

Please contact us by email at info@lloydosullivan.co.uk or call 020 8941 9779 to see how we can assist you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.

Workplace pensions are regulated by The Pension Regulator.

Production

Production