The pension fund built during your working life is designed to support you throughout your retirement. With life expectancies rising, this might mean another 30 or even 40 years after you give up work.

If you worry that your pension pot won’t be large enough to support you in the decades that follow the end of your career, there’s no need to panic just yet.

There are some simple steps you can take, even as retirement nears, that can make all the difference. Keep reading to find out about just five of them.

1. Start early

Any investment needs to be thought of in the long term. Your pension is no exception. Starting early allows you to make more contributions, while also benefiting from the effects of compound growth.

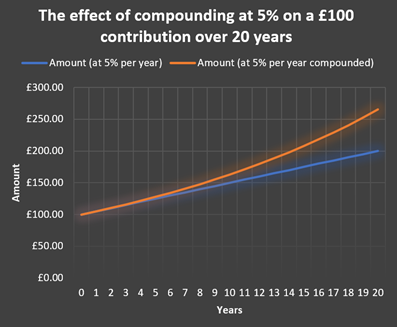

Compounding is an important part of long-term wealth generation. It means that you don’t just earn interest on the amount you contribute, but on the interest on that amount too.

Say you start with a £100 contribution, growing annually at 5%. At the end of 20 years, your fund will have grown to over £265 through compounding, compared to just £200 with simple interest.

As the number of contributions grows, and the value of those contributions increases (as you begin to earn more money), the size of your pension pot gets an added boost too.

Starting as early as possible gives you the best chance to build a large pot, but maximising contributions later in life can also make a dramatic difference as retirement approaches.

As you progress in your career and begin to pay off a large debt, such as a mortgage, you might use the additional money – or that from bonuses or pay rises – to make one-off lump sum contributions to give your pension a last-minute boost.

2. Understand your attitude to risk

Figures published in This is Money in August 2020 found that more than two-thirds of Brits don’t understand that their workplace pension is invested in the stock market.

But understanding how your pension works is crucial to getting the most out of it. You’ll need to think about your attitude to risk and remember that your risk profile isn’t static.

Early in your career, you might contribute less each month, but you should also be in a position to take a higher amount of risk. Even if the stock market dips – as it did at the outbreak of the coronavirus pandemic – your investments still have a long time to recover.

As you approach retirement, your attitude to risk will change. This is because any sudden dip that occurs just at the point you need the money leaves no time for your fund to recover. This could make an enormous difference to the amount you take into retirement.

We can help you manage investment risk in your pension (and in your investment portfolio) to help ensure you see the best possible returns for the lowest possible risk.

3. Make the most of your employer contributions

Auto-enrolment was introduced in 2012 and according to figures released by the Office for National Statistics (ONS) back in May, the proportion of eligible staff enrolled on a workplace scheme has risen from around 46% in 2012 to nearly 8 out of 10 UK employees (78%) in April 2020.

The current minimum contribution is 8%, of which you pay 5%, with your employer topping up the extra 3%.

Making the most of this employer contribution, on top of the tax relief your payments already attract, is key to maximising your fund. You might find that if you increase your contribution above the maximum, your employer will up their contribution too.

4. Maximise your State Pension entitlement in the run-up to retirement

You can check your current State Pension entitlement to see how much State Pension you are likely to receive. Also, check whether you can pay additional contributions to make up any gaps.

While your State Pension is unlikely to form the majority of your retirement fund, failing to claim your full entitlement means missing out on money that could make all the difference in retirement.

Despite the temporary suspension of the triple lock, the full new State Pension is worth £9,339.20 a year for the 2021/22 tax year, rising to £185.15 a week (or £9,627.80 a year) for 2022/23.

Understanding how much you are entitled to might mean you can opt to defer your State Pension, thereby receiving a higher income when it does commence.

5. Take advice

Whatever stage of your retirement planning you are at, speaking to experts can make all the difference.

By getting to know you and the whole of your finances, we can build a plan that is individual to you. Based on your financial position now, as well as your plans for the future, we will use our decades of experience to work out the most tax-efficient way to build your retirement fund.

Knowing that your future is in safe hands will give you confidence in the present, allowing you to enjoy the run-up to your retirement. Why not get in touch and see what we can do for you?

Get in touch

If you’d like advice on your current pension contributions or your long-term retirement plan, please get in touch. Email info@lloydosullivan.co.uk or call 020 8941 9779.

Please note:

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The value of your investments (and any income from them) can go down as well as up, which would have an impact on the level of pension benefits available.

Production

Production