Planning for retirement is one of the most important steps you’ll take in life, helping you to live your desired lifestyle post-work.

Building towards retirement with a clear plan should prevent you from retiring with a pension shortfall.

Keep reading to discover seven simple mistakes to avoid when saving for your retirement.

1. Never reject “free money” from your employer

If you’re employed, you have likely been automatically enrolled in your workplace pension scheme.

While you can opt-out if you choose, this could be a mistake. That’s because your workplace pension fund doesn’t just comprise the 5% contribution from your earnings.

Your employer will also contribute a minimum of 3%. Some employers might even pay more or match extra payments you make.

By opting out of a workplace pension you’ll lose your own contribution and what is essentially “free money” in the form of your employer’s contributions.

2. Don’t miss out on the tax benefits

The government encourages people to save for their retirement by offering tax relief on pension contributions.

If you’re a basic-rate taxpayer, you get 20% tax relief on your contributions in the 2022/23 tax year. For every £100 you pay into your pension plan, you’ll receive £20 of tax relief on the payment, meaning it only costs you £80.

Pausing or reducing your contributions means you could lose out on this valuable relief. Additionally, if you’re a higher- or additional-rate taxpayer, you can claim additional tax relief through your self-assessment tax return.

3. Less now means less later, so don’t just contribute the minimum

Contributing the minimum amount to your pension pot each month (5% if you’re in a workplace pension scheme) is unlikely to get you the kind of retirement lifestyle that you desire.

It is important to work with a financial planner to carefully calculate how much your desired level of comfort will cost and how much you’ll need to set aside to achieve it.

You can then reflect on your monthly budget, hopefully raising your contributions and increasing the chances of reaching your long-term goals.

4. Don’t rely on the State Pension to cover your retirement costs

While the State Pension provides a valuable guaranteed, inflation-proof income, it is unlikely to be enough in itself to provide for your chosen lifestyle.

The State Pension isn’t available to you until your late 60s and is unlikely to cover all your household outgoings. As of the 2022/23 tax year, the full new State Pension is £185.15 per week, or £9,627.80 a year.

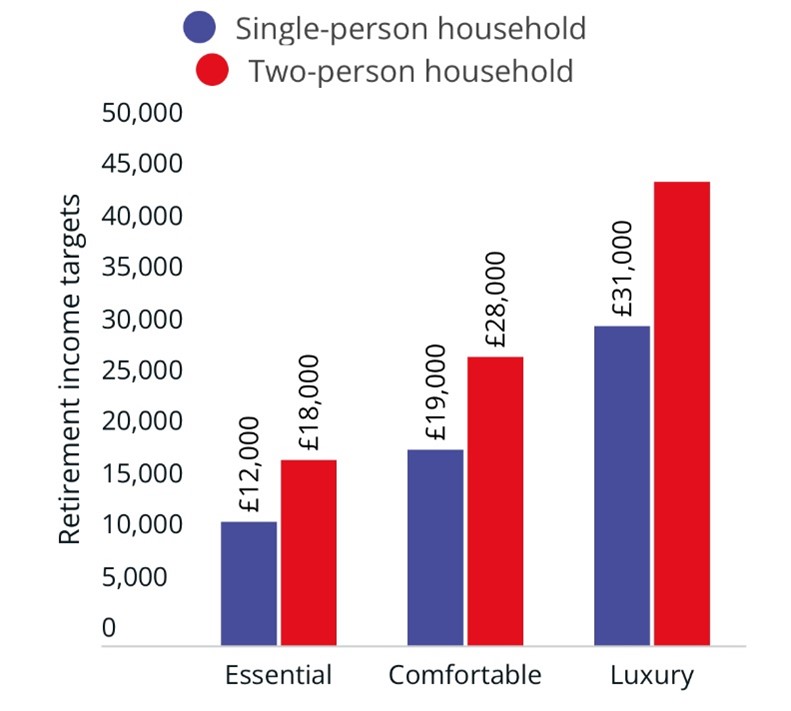

Which? surveyed thousands to determine how much they spent each month and what they spent it on.

Source: Which?

Retirees living a “comfortable” lifestyle including covering their household expenses as well as a monthly eating-out budget and an annual European holiday required £19,000 for a single-person household and £28,000 for a couple.

This far exceeds the State Pension. Even those paying only for essentials will require more than the State Pension provides.

Without additional pension savings and other income avenues, you are unlikely to achieve your desired retirement lifestyle.

5. Don’t forget to keep tabs on your pension plans

Throughout your lifetime, you might change jobs several times and, in doing so, you may find yourself contributing to various workplace pension schemes. It’s very easy to lose track of these schemes, possibly by forgetting to update your contact details.

Pensions Age reports that lost or dormant pension pots currently total £37 billion, held across 1.6 million UK savers. This works out as an average value of £23,125 per saver.

Keep track of your workplace pension plans and send your updated details to scheme administrators when changing jobs. If you’ve lost track of any plans, you can trace lost pensions through the government website or speak with us.

6. Don’t assume retirement expenses are consistent through your 60s, 70s, and 80s

Dependent on when you choose to retire you could need your savings to provide an income for 20, 30 or even 40 years. These expenses won’t be static throughout your retirement years.

Typically, spending is slightly higher when you first retire. If you’re in good health you’ll want to start enjoying your freedom, perhaps by travelling or taking up hobbies or activities. This will usually slow in your 70s.

However, your spending could then rise again in your 80s if you have to pay for additional care.

It is important to understand that your income needs may change throughout retirement and that you should plan accordingly.

By working with a financial planner, you can plan sustainable withdrawals throughout your lifetime, without running out of money or leaving too much behind.

7. Don’t miss out on the benefits of saving for your pension early

Throughout a lifetime, even small savings can add up. Starting early means a longer time for the benefits of compounding to take effect.

Many young workers choose not to save into a pension and opt out of workplace schemes.

Unbiased reports that nearly a quarter (24%) of workers under the age of 35 claim to have no pension savings at all. Surprisingly, one in six workers over 55 still don’t have any pension savings set aside.

Get in touch

A long-term financial plan and regular advice will help to ensure your retirement stays on track – whatever happens.

To find out how we can help you achieve the retirement lifestyle you want, please get in touch. Email info@lloydosullivan.co.uk or call 020 8941 9779.

Please note:

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

Production

Production