The start of a new year is a great time to make resolutions, banish unhelpful habits, and build healthier ones.

Research by YouGov reveals that more than a quarter of adults in the UK plan to make new year resolutions for 2025.

So, if you’re busy setting goals for the “new you”, don’t forget to think about your financial wellbeing.

Here are three healthy financial habits that could help boost your wealth in 2025 and beyond.

1. Pay yourself first

It might be tempting to prioritise your short-term spending needs over saving or investing for the future. In the moment, buying that beautiful new watch or luxury holiday could feel more important than topping up your ISA.

Yet, saving and investing consistently could help you accumulate the wealth you need to achieve your long-term financial goals, such as having financial freedom in retirement or passing wealth to the next generation.

So, if you’ve fallen into the habit of waiting until the end of the month and saving or investing whatever money you have left, you could be missing a trick.

Instead, “paying yourself first” might help you build a healthy saving and investing habit. This means treating your contributions to your pensions, savings, and investments as an essential bill, paid as soon as your income lands.

You may find it helpful to set up monthly automated payments to these accounts. This might encourage you to plan your spending around your savings and investments, rather than vice versa.

2. Base your financial decisions on logic and data

Your financial situation could affect all areas of your life, from how well you can provide for your family to where you live. So, perhaps it’s not surprising that emotions often play a part in financial decision-making.

Unfortunately, letting your emotions guide you might make it harder to achieve your financial goals.

For example, a fear of losing money could mean that you favour low-risk investments that limit your returns. Alternatively, you might panic-sell your shares as soon as there is a dip in the market. As a result of these and other emotion-based decisions, you could miss out on any future potential gains your investment might have made.

Indeed, research by the Nobel prize-winning psychologist and economist Daniel Kahneman has shown that we are hard-wired to feel losses twice as intensely as the pleasure of gains. He called this “loss aversion”.

Fortunately, focusing on the data and thinking logically could help you avoid making emotional decisions.

A financial planner could also play an invaluable role as an objective sounding board. They can use their knowledge and experience to help you avoid knee-jerk reactions and think through key financial decisions in a considered way.

3. Make your money work hard by investing it

According to Money Marketing, an estimated 13 million UK adults are holding £430 billion of “possible investments” in cash deposits. The research found that many UK adults are reluctant to invest because they worry about the risk involved or lack the knowledge to get started.

However, while cash savings can be useful for short-term expenditures or emergency funds, they may not be a good strategy for accumulating the wealth you need in the long term.

This is because any money you hold in cash savings may lose purchasing power over time unless the interest rate on your savings account is consistently higher than the rate of inflation.

In contrast, investing in the stock market could help your wealth keep pace with inflation.

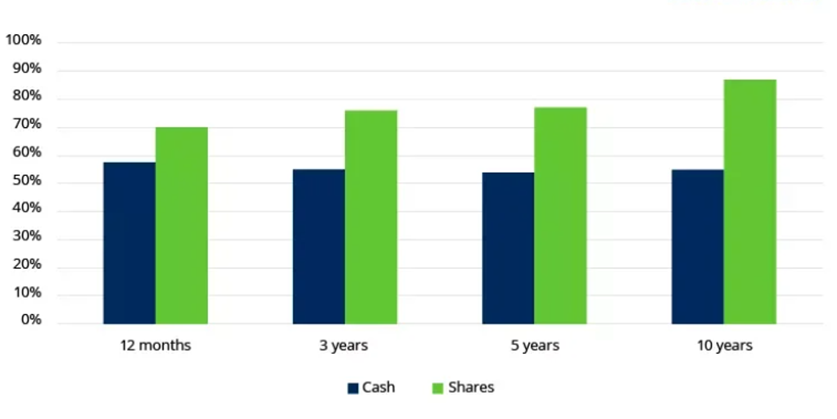

The graph below shows the percentage chance of beating inflation with cash and shares over different time frames.

Source: Schroders

As you can see, historically, cash savings have had around a 55%-60% chance of beating inflation no matter how long you hold on to your savings. On the other hand, there has been a nearly 90% chance of shares beating inflation over 10 years.

So, if you’re not currently investing any of your wealth on a regular basis, this might be a healthy financial habit to adopt in the new year.

If you’re not sure how to get started, a financial planner can help you build a portfolio that aligns with your long-term goals and tolerance for risk.

Get in touch

If you’d like help reviewing how you approach your finances in the new year and building a strategy for achieving your long-term goals, we’d love to hear from you.

Please get in touch by emailing info@lloydosullivan.co.uk or call 020 8941 9779 to see how we can assist you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production