Wrapping your head around investing can seem somewhat daunting at first, especially when you’re faced with complex data and an overwhelming number of options.

In fact, research from FTAdviser reveals that 1 in 5 UK adults have significant gaps in their investment knowledge, having never heard of a Stocks and Shares ISA.

Without a clear understanding of how investing works, or even how to get started in the first place, you may find that you delay taking action altogether.

Yet, investing can be a beneficial way to work towards your long-term goals and bolster your financial wellbeing.

Inflation – which the Office for National Statistics reveals reached 3.5% in the 12 months leading to April 2025, as measured by the Consumer Prices Index – still remains higher than expected. This could mean that holding all of your wealth as cash savings erodes its real-term value.

Conversely, investing could allow your wealth to keep pace with inflation, potentially delivering competitive returns.

With that in mind, continue reading to discover some of the benefits of investing, and some steps to help you get started with confidence.

Investing typically offers competitive returns compared to cash savings

Simply put, investing involves purchasing shares in companies, bonds, or funds that hold a range of assets. The idea is that, by doing so, you can passively generate growth.

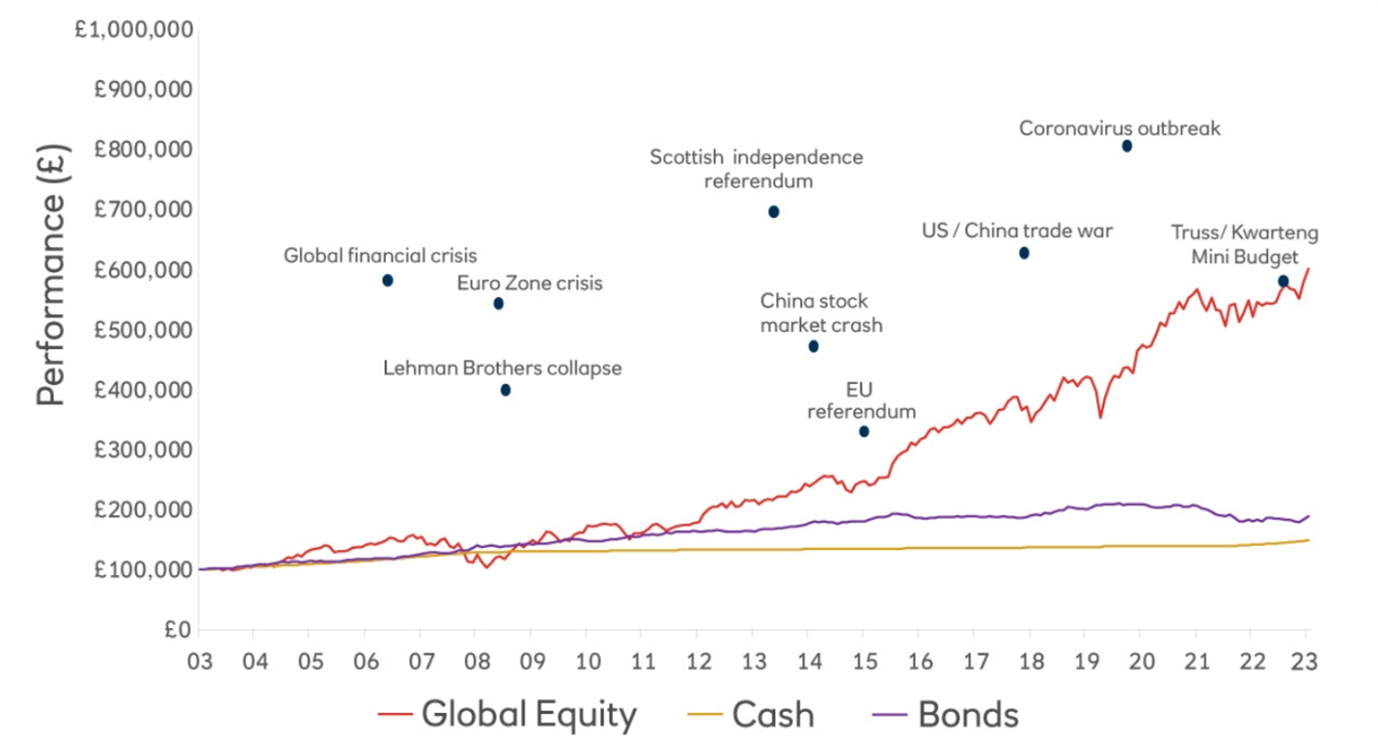

While past performance certainly isn’t indicative of future results, investing has consistently outperformed cash savings over the long term, as the table below from NatWest shows.

Source: NatWest

While there was a slight dip between 2007 and 2009 during the financial crisis, and an even more significant one during the Covid-19 pandemic, global equities have performed far better than cash over the long term.

You may also benefit from dividend income when you invest, which is a regular payment from owning a stake in a company.

You could use this to supplement your income, either during your working life or in retirement.

There also exist several tax-efficient investing vehicles, such as Individual Savings Accounts (ISAs), as these protect your gains from Income Tax, Capital Gains Tax, and Dividend Tax.

Just remember that investing carries risk, including the possibility that your investments may decline in value. This is why it’s vital to understand the basics and have a clear plan in place before you start. Read on to discover five helpful tips for starting your investing journey.

1. Start by identifying your goals

Before committing any money to investing, it’s essential to identify your reasons for doing so. Setting these goals can help you choose appropriate investment options and remain focused through inevitable volatility.

You could start by thinking about your time frames. For instance, you might wish to save for the deposit for a home in five years, fund a child’s higher education in 10 years, or grow your pension fund over the next 25.

Typically, the longer your time frame, the more risk you can typically take on; shorter-term goals, on the other hand, may require a more cautious approach.

This clarity could also help you measure progress over time and allow you to make more informed decisions regarding your wealth.

2. Understand your appetite for risk

As mentioned, investing will always carry risk, and returns are never guaranteed. That’s why it’s so important to understand your risk tolerance.

Your capacity for risk depends on your aforementioned time frame and how you respond to market movements.

For instance, if you believe you would be more likely to make knee-jerk reactions in response to volatility, you may want to take on slightly less risk.

It’s worth noting that, while holding all of your wealth in cash might seem safer, it’s all about context. Investing in a balanced portfolio may involve short-term fluctuations, but it typically offers a better chance of growing your wealth over time.

This is why it’s so vital to find a balance of risk that aligns with your goals, and continue to review this as your circumstances change.

3. Diversify your portfolio

Perhaps one of the more important principles in investing is diversification. This means spreading your money across various asset classes, sectors, and geographical areas, to reduce the effects of a single area underperforming.

For instance, if tech stocks do experience a sudden decline, gains from healthcare companies could offset losses, helping you keep a cool head and avoid emotion-led decisions.

You may also want to consider diversifying over time. By investing regularly, you may reduce the risk of entering the market at a high point, an approach known as “pound cost averaging”.

4. Beware of shortcuts

In this modern age of social media and financial influencers – known as “finfluencers” – it’s easy to get drawn into “get rich quick” schemes or unregulated opportunities.

These tend to promise high returns for little or no risk. However, in reality, higher returns tend to come with higher risk, and vice versa.

This is why it’s so important to carry out due diligence before making investments.

If you do receive an offer from an “investment company” with a “once in a lifetime” opportunity, you should cross reference the source of the financial offer to ensure everything’s above board.

If the offer comes from a private company, you can search for the name of that institution on the Financial Services Register offered by the FCA. This is a database of all FCA-authorised companies, so if you can’t find the name of the business or individual offering the investment on this database, it may be wise to avoid it.

5. Seek professional advice

While there are plenty of resources available out there to help you and platforms that allow you to invest, you might benefit from working with a qualified financial planner.

A professional could help you clearly understand your goals, assess your tolerance for risk, and review your progress over time.

This could help deliver real value. In fact, Unbiased reports that, on average, financial advice can make people nearly £48,000 better off in pensions and financial assets.

Aside from the financial benefits, professional support can help you secure some much-needed peace of mind knowing that you are less likely to make mistakes as a beginner investor.

Please get in touch by emailing info@lloydosullivan.co.uk or call 020 8941 9779 to see how we can assist you.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

The Financial Conduct Authority does not regulate tax planning.

Production

Production