Climate change has moved into mainstream chatter over the last few years and become a hot topic — literally — in socially conscious circles.

Ethical investing is becoming a greater priority for investors, as individuals seek to align their goal of generating financial growth with their politics, beliefs, and issues that are close to their hearts.

Keywords such as sustainable, eco-friendly, and socially conscious have become part of the vocabulary of many consumers and businesses.

One way for investors to support their environmentally conscious views while investing is to consider Environmental, Social, and Governance (ESG) funds.

Before making any big decisions regarding your financial portfolio, it is important to first understand the current landscape of the “green economy”, as well as what ESG funds actually involve.

Read on to learn about the make up of ESG funds and the key points you need to know before opting to invest.

What are ESG funds

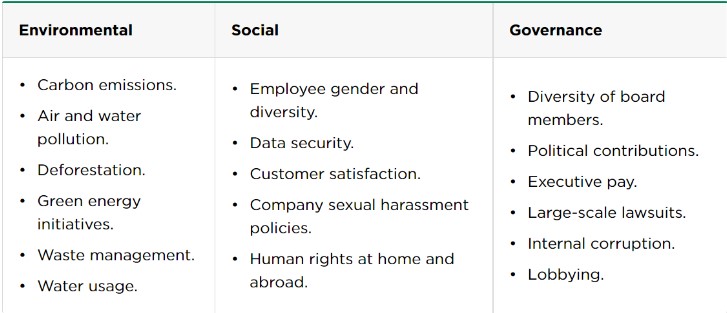

ESG funds use non-financial factors to help guide investors by measuring an investment or company’s sustainability, as well as other key criteria. Environmental factors focus on conservation efforts, social factors outline how a company treats both its employees and consumers, and governance factors consider how ethically a company is run.

Large external agencies such as MSCI, RobecoSAM, Sustainalytics and Vigeo Eiris, use ESG criteria to assign a business its ESG rating.

An investment’s ESG score measures the ability of an investment to match the criteria of the ESG’s specific categories.

Nerdwallet outlines the key areas that an agency will look at for each of the ESG’s three categories:

Source: Nerdwallet

ESG investing can push companies to adopt ethical corporate policies and encourage them to act more responsibly.

Many brokerage firms and mutual funds now offer investment products that fit ESG criteria.

The benefits of ESG investing

Beyond the obvious social benefits, ESG investing can have other benefits for potential investors.

In holding companies to the standards outlined in ESG criteria, it ensures they need to be mindful of their business practices and helps guide investors towards avoiding unethical companies that may ultimately be held accountable for their actions and face serious financial repercussions.

Some infamous examples include Volkswagen’s emissions scandal and BP’s 2010 Gulf of Mexico oil spill — two incidents that rocked their respective companies’ stock prices and cost them billions.

ESG could reduce the risk associated with your investments and provide additional protection for your funds.

A 2019 white paper by Morgan Stanley found that in periods of unstable and volatile markets such as 2008/9, 2015, and 2018 — traditional funds had greater losses on average than sustainable funds.

ESG investing can also be a vehicle to promote changes within the business world such as pushing companies to diversify their senior staff positions, work towards net zero carbon goals, reinvesting in their local communities, and being more transparent with consumers regarding their practices and products.

FTAdviser reports that for 14% of ESG investors the positive impact of the funds on key social issues is their driving reason for investing. But for the majority (approximately 80%) financial performance remains the main reason they select ESG investments.

Morgan Stanley’s white paper compared the performance of ESG funds against traditional funds from 2004 to 2018 and discovered that the total returns of sustainable funds were on par with traditional funds over the period. Other studies have shown that ESG investments can outperform conventional ones — either way, once social benefits are factored in ESG funds seem more beneficial.

However, the rapid growth of ESG investment funds in recent years has led to doubt as to whether all companies that claim they’re ESG-compliant are being truly honest and transparent.

This is an issue known as “greenwashing”.

Problems with greenwashed businesses and the downside of ESG investing

As businesses seek to appease socially conscious individuals on the surface, while actually not making any significant changes behind the scenes, greenwashing is a very real issue for investors.

Sustainable Brands reported on an investigative edition of Last Week Tonight with John Oliver in which they covered the topic of greenwashing and carbon offsets.

John and his team found that many companies claiming to be working towards being carbon neutral and using carbon offsets goals were actually working the system to allow them to maintain emissions while claiming to be working ethically.

According to Unbiased, investing in ESG products rose 140% in 2020, meaning the importance of ensuring ESG-claiming businesses are actually fulfilling their duties is becoming increasingly essential.

Even if you do invest in a truly ESG-compliant business, it is important to note that ESG investing limits your options available in the market. There are many major industries such as tobacco or defence that will be unlikely to be ESG-compliant – yet are two industries that typically see very high returns for investors.

ESG investing can also be a more costly practice as the average ESG-friendly investment trades at a premium.

It is ultimately about your own personal goals

If promoting social or environmental change is important to you, you will see a benefit from ESG investing regardless of your investment’s performance. Anything additional may just be the cherry on the top of your sundae in the end.

It all depends on your personal priorities and views. If you want your investments to align with your values, then ESG funds could be a good starting point.

Get in touch

If you would like to know more about ESG investing and how it can benefit your portfolio, please contact us by emailing info@lloydosullivan.co.uk or calling 020 8941 9779.

Please note:

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Production

Production