Reducing your tax bill can help your wealth to grow more effectively. And, with tax changes, allowance threshold freezes, and the cost of living crisis all affecting household finances this year, managing your tax liability is more important than ever.

Keep reading to find out about the tax changes that could affect you this year and how to mitigate their impact.

Tax changes coming this year

Dividend tax

You’ll typically pay Dividend Tax if you earn more than £2,000 in dividends outside of an ISA or pension. This could be the case if you run your own business and pay yourself dividends.

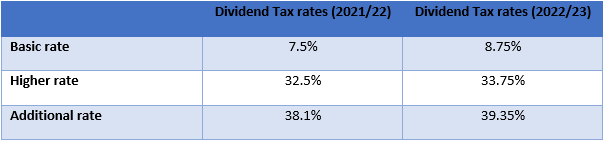

Dividend Tax rose by 1.25 percentage points in April 2022.

Source: HMRC

If you’re a higher-rate taxpayer taking £20,000 in dividend payments, then you will now pay 33.75% on £18,000 of dividends. This would result in a Dividend Tax bill of £6,075, up £225 when compared to the previous tax year.

This is a significant change so it’s important to be aware of how this could affect your tax bill.

National Insurance contributions (NICs)

To help tackle the social care crisis, and to aid the NHS’s Covid recovery, NICs rose by 1.25 percentage points on 6 April 2022.

While this increases the NICs you pay, the chancellor subsequently announced he would raise the National Insurance Primary Threshold and Lower Profits Limit, for employees and the self-employed respectively, from July 2022.

The change will equalise the NICs and Income Tax threshold, meaning you can earn up to £12,570 a year without paying any Income Tax or NICs.

Around 30% of NICs payers will pay more contributions, even accounting for this rise in the threshold.

Personal Allowance

The Personal Allowance has been frozen this year. It remains at £12,570 for 2022/23, while the higher- and additional-rate thresholds – £50,270 and £150,000, respectively – also remain unchanged.

An increase in earnings, whether through a pay rise or due to pension withdrawals, could see you pay more tax, especially if your earnings push you into a higher tax bracket.

How to reduce your tax bill

ISAs

One simple way to save tax-efficiently is to use an Individual Savings Account (ISA).

An ISA has several tax benefits. You don’t pay tax on any interest you make on a Cash ISA and returns on a Stocks and Shares ISA are free of Income Tax and Capital Gains Tax (CGT).

Making the most of your ISA allowance (£20,000 in 2022/23) can help your wealth to grow tax-efficiently.

If you are a first-time homebuyer, aged between 18 and 39, you might also consider a Lifetime ISA (LISA). You’ll receive a 25% government bonus on your contributions, in addition to tax-efficient growth.

You can contribute up to £4,000 a year into a LISA, which counts towards your overall ISA subscription.

Pensions

Pensions are another popular way to save for retirement and reduce your taxable income.

Generous tax relief on your contributions means that a £100 pension contribution typically only “costs” a higher-rate taxpayer £60. It makes them a very tax-efficient way to build up wealth for later life.

Each year, you can usually contribute up to £40,000 (or 100% of your earnings, if lower) into a pension tax-efficiently.

If you want to contribute more than this, you may be able to carry forward some unused Annual Allowance from previous tax years. Speak to us if you’re thinking about boosting your pension and benefiting from the generous tax perks.

Other exemptions and allowances

There are several other tax allowances and exemptions that can help you to cut your tax bill. These include things like salary sacrifice, which allows you to reduce your taxable income by sacrificing part of your salary in exchange for benefits like additional pension contributions, a company car or private healthcare.

Other tax allowances to consider include:

- The annual £3,000 Inheritance Tax (IHT) gifting exemption. You can gift up to this amount each year and this will immediately fall outside your estate for IHT purposes.

- The £12,300 CGT annual exempt amount. You can make profits of up to £12,300 (2022/23) on assets such as non-ISA investments and second homes without paying any CGT.

- The Marriage Allowance lets you transfer £1,260 of your Personal Allowance to your husband, wife, or civil partner. To use this, one of you must be a basic-rate taxpayer and the other must have income below the Personal Allowance.

Get in touch

Reducing your tax bill means more money, reduced stress levels and peace of mind.

If you’d like help to reduce your tax bill, get in touch. We can assess your current situation and help you make an informed decision that fits your unique circumstances.

Email info@lloydosullivan.co.uk or call 020 8941 9779 to see how we can help you.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Production

Production