If you read your recent Lloyd O’Sullivan guide to ISAs, you’ll know that ISAs can be incredibly tax-efficient ways to save and invest. Yet, many people aren’t proactive, leaving important decisions until the end of the tax year.

Treating your Stocks and Shares ISA as a priority, though, could have benefits in the long run.

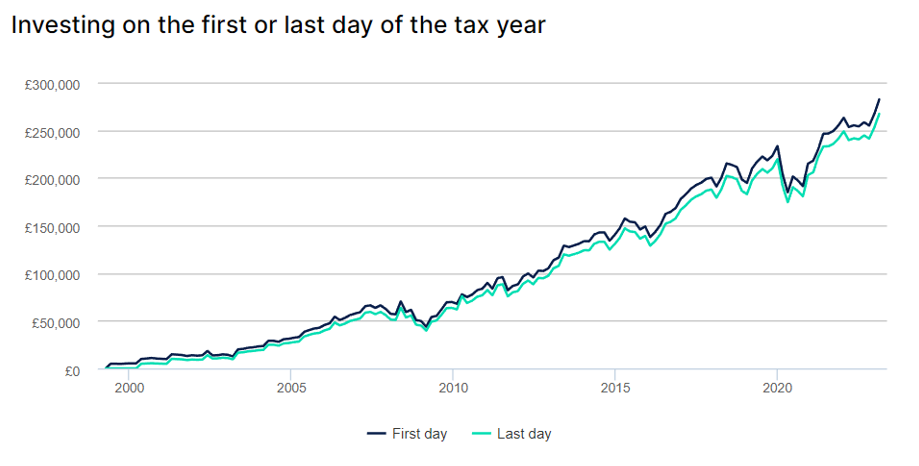

According to research by Hargreaves Lansdown, early bird ISA investors – those who opted to invest at the start of the tax year, rather than the end – typically saw better returns.

So, taking steps to invest your full ISA allowance early, could help boost your wealth.

Early bird ISA investors showed 8% greater growth on their investments than end of tax year investors

There are several types of ISAs available, including a Cash ISA and a Stocks and Shares ISA.

Stocks and Shares ISAs could offer you valuable tax benefits, such as:

- Gains made within a Stocks and Shares ISA are free from Income Tax

- Profits on the sale of assets within a Stocks and Shares ISA are free from Capital Gain Tax (CGT)

- Dividends received from investments within the ISA are tax-free and don’t count towards your annual Dividend Allowance.

However, one additional benefit that may be lost to many investors comes as a result of timing.

For the 2023/24 tax year, it is possible to invest a maximum of £20,000 into your ISA. Hargreaves Lansdown looked at the difference in returns for investors contributing at the start of the tax year compared to the end, between 1999 and 2023.

Source: Hargreaves Lansdown

Investors paying £5,000 into an ISA each year — £120,000 for the period — saw positive returns whether they invested early or late in the tax year. However, those who invested early were £15,073 better off on average (excluding charges).

These early bird investors saw growth of 128% compared to 120% for end of tax year investors.

Past performance is no guarantee of future success, but additional investment time may prove beneficial.

3 simple tips for getting the most out of your ISAs

1. Develop a good investing habit

You might not have £20,000 set aside to invest at the start of each tax year. However, investing what you can as early as possible, allows you to gain maximum benefit from compounding returns.

Opting to regularly top up your initial investment throughout the remainder of the year – by as little as £100 each month – could make a significant difference to your pot given time.

Scheduling monthly contributions can also help you get into a good habit of maintaining your ISA investments and gives you plenty of opportunities to ensure you’re using your ISA Allowance before the end of the tax year arrives.

2. Maximise your allowances

The tax benefits associated with ISAs shouldn’t be underestimated. If you have surplus funds sitting in a standard savings account, they might be put to better use in an ISA.

It is important that you consider using your full ISA Allowance so that you can reap the maximum benefit.

For the 2023/24 tax year, you have a £20,000 ISA Allowance which you can split between the ISAs you hold. Otherwise, you can simply put all your funds into one.

You could also invest in a Junior ISA (JISA) on behalf of your children or grandchildren under the age of 18. A JISA has an annual JISA Allowance of £9,000 (2023/24 tax year).

3. Understand the benefits of different ISA types

There are various types of ISAs with their own respective benefits. The main types are:

- Cash ISAs

- Stocks and Shares ISAs.

The interest earned in a Cash ISA is free of Income Tax. However, the money in a cash ISA is saved, not invested, and so is unlikely to see the same level of growth that stocks and shares can deliver.

Stocks and Shares ISAs offer the chance for bigger returns but with added risk. Stocks and Shares ISAs may see losses dependent on the market’s performance.

Get in touch

If you’re interested in saving or investing in an ISA, it is important to gain a better understanding of what it might mean for your overall financial plans. A good first step could be to get in touch by email at info@lloydosullivan.co.uk or by calling 020 8941 9779.

Please note:

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Production

Production