Your financial plans are likely to factor in a variety of challenges and goals, like how to build a sustainable retirement income that lets you live the kind of life you desire.

You might think that once you’ve saved enough and reached retirement it’s all smooth sailing. But unexpected issues can arise at any point in life and your later years have the increased potential for health problems that might raise costs and require specialised care.

This is where protection comes in, as the right cover could leave you better prepared to face any difficulties and help you pay for additional costs during retirement.

Read on to discover why you shouldn’t underestimate the value of protection during retirement and how it might help you with healthcare issues, care costs, and your estate plans.

Even the most fit and healthy individuals may face unexpected health issues in their 70s and 80s

It is an inevitable part of the ageing process that as your body grows older, you become more susceptible to a wide range of physical and mental healthcare issues.

You may have already taken steps to stay fit and healthy for as long as possible, such as staying active, adjusting your diet, and focusing on your overall wellness.

Additionally, you may have considered the effects of insufficient sleep and stress levels on your life expectancy.

Read more: Irregular sleep shortens life expectancy. Here’s how to rescue yours

However, health issues can and will arise. These issues could require specialist treatment, and additional costs that could stretch your retirement income.

Degenerative mental conditions, such as dementia, could leave you unable to care for yourself

According to the Guardian, the financial and emotional toll on families caring for loved ones with dementia in the UK is progressing towards a crisis point.

Currently, more than 700,000 people in the UK provide care for loved ones suffering with dementia. They face ongoing challenges arising from limited public care options and prohibitive private care costs.

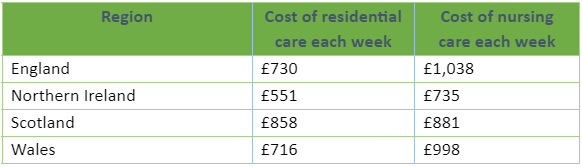

Which? reports that the average costs of private care can be significant:

Source:Which?

The financial cost is clear. But getting the right level of care could not only greatly improve your wellbeing, but that of your loved ones too, especially where they are responsible for your care needs.

Ensuring funds are available to cover costs could help take the pressure off your carers’ shoulders.

The emotional toll on your loved ones could be compounded by money worries without vital protection plans in place

If you become ill, or you die, without the necessary protections in place, your loved ones could find themselves struggling financially at a time of enormous emotional stress.

Here are two important types of protection that could provide valuable later-life solutions.

1. Critical illness cover

Critical illness cover is designed to support you financially if you’re diagnosed with one of any serious health conditions included in your policy.

It will typically pay out a tax-free, one-off payment that helps pay for your treatment or any other financial pressures arising from your health issues. This might include changes to your home to support your decline in health or care home costs. Once your policy has paid out, it will usually end.

The conditions and illnesses covered vary between different providers and plans, but could include:

- A stroke or heart attack

- Certain types of cancer

- Parkinson’s disease.

Additionally, many policies will also consider permanent disabilities as a result of injury or illness. If you need specialised treatment or require relocating to a care home, critical illness might help you cover the cost.

2. Life insurance

Some life insurance policies can pay out early in instances of serious illness or terminal diagnoses, however this depends on the specifics of your agreement.

The main focus of life insurance, though, is to provide a payout to your beneficiaries once you’re gone.

There is a lot of misinformation surrounding life insurance cover, so it is important that you stay properly informed and carefully consider the benefits of having protection in place.

Read more: 4 of the biggest life insurance myths — here’s what you actually need to know

One often overlooked benefit of life insurance is that it can help to lower or avoid an IHT bill, if you put your life insurance plan into a trust.

In most circumstances, your life insurance payout will count as an asset within your estate and could be liable for IHT at 40%.

But, if you put your life insurance policy in trust, and effectively legally pass its ownership onto your named beneficiaries or “trustees”, it is typically no longer counted for IHT calculation purposes. So, when it pays out, your loved ones will normally be able to get the full payout.

Get in touch to discuss how cover fits into your financial plans

Protection could provide you with significant emotional and financial relief, as well as peace of mind. However, it’s important you get the right cover in place for you.

To discuss things further and receive in-depth advice, you should email us at info@lloydosullivan.co.uk or call 020 8941 9779.

Please note:

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Note that life insurance plans typically have no cash in value at any time and cover will cease at the end of the term. If premiums stop, then cover will lapse.

Production

Production