Interest rates in the UK are on the rise which under normal circumstances would be a positive sign for savers.

However, the UK is experiencing a period of soaring inflation at levels not seen in 40 years, which is far outpacing any rises in interest rates.

Some savers have left themselves especially exposed to the eroding effect of high inflation on the “real” value of their cash savings. Moneyfacts reports that £300 billion is currently languishing in savings accounts with rates of 0.1% or less.

Inflation has already peaked at 10.1% (for the year to July 2022), although the most recent figures from the Office for National Statistics (ONS) confirm a slight drop to 9.9%. Nonetheless, the Guardian reports that inflation could reach as high as 18% by early 2023.

So, what does this mean for your cash savings and why is their real value currently diminishing despite rising interest rates?

Discover a few ways you can protect your surplus cash and ensure you remain on track to meet your long-term goals.

Inflation remains high as the UK enters its third recession this century

The current cost of living crisis has been caused by a maelstrom of recent global events from the pandemic to the war in Ukraine to the ongoing gas shortage. As global supply chains have been disrupted, the demand for certain goods and services has risen sharply.

The Office for National Statistics (ONS) reported inflation of 10.1% for the year to July 2022, although it has dropped to 9.9% for August according to latest ONS figures. The Bank of England (BoE), meanwhile, forecasts inflation to reach 13% this autumn and it is expected to continue to rise next year.

As previously mentioned, £300 billion is currently sitting in savings accounts with interest rates of 0.1% or less. Here’s an example of what happens to cash in low interest savings during periods of high inflation.

If you had set aside £1,000 in an account at 0.1% a year ago, it would be worth £1,001 today. However, the cost of £1,000 of goods and services a year ago would now cost £1,101 today at the current rate of inflation.

The value of your savings will have diminished, and you’re effectively left £100 worse off.

It is hard to predict exactly when inflation will start to go down and forecasts for the coming year have continually been updated to increasingly higher levels as the year has progressed.

So, with a recession on the horizon, how can you look to protect your cash savings from erosion by inflation? And what is being done to combat the current situation?

The changing BoE base rate will benefit your savings but negatively affect your debt obligations

The bank rate, also known as the “base rate”, is the BoE’s means of influencing interest rates across the UK. If the base rate rises, then creditors across the UK will follow suit, and if it drops then commercial rates typically drop too.

The BoE has a 2% inflation target set by the government. It tries to influence inflation through the use of the base rate. A rising rate encourages saving as the cost of borrowing increases and conversely a reduction in the rate can influence people to spend more.

This has a domino effect on inflation and can help bring it back under control.

The BoE base rate is currently 1.75% and is expected to rise again this year. As interest rates on savings accounts increase, it is worth considering moving your cash savings into an account with the best possible returns, especially if your savings are currently in an account with rock bottom rates.

Moneyfacts reports that the best rate for an easy access savings account is 1.81% as of 9 September 2022. The rates on long-term fixed-rate accounts have even better returns.

It is important to have cash set aside for emergencies in easy access accounts. Typically, three months of savings for key bills such as rent, utilities, and groceries is likely to be enough.

However, in times of high inflation, be sure not to hold too much in cash. Not only will it be effectively losing value in real terms, but there might be better uses for it.

You might consider paying your debt obligations early. As interest rates rise, so do the monthly payments and overall cost of debt agreements like variable-rate mortgages, credit cards or loans.

Opting to use surplus cash to pay off debts now, while rates are still historically quite low, could save you money in the long term, especially if interest rates are expected to continue to rise.

Alternatively, you could consider the benefits of investing your funds.

Investing could offer better opportunities for generating the growth needed to meet your goals

Investing your surplus cash in the stock market could offer higher returns, albeit with added risk.

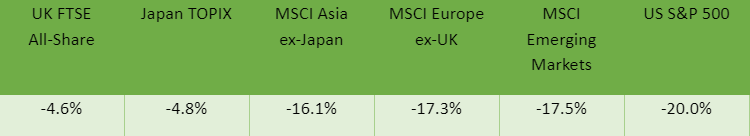

Stock markets around the world have been affected by 2022’s turmoil. The table below details the performance of a few of the world’s major stock market indices in the year to the end of June 2022.

Source: JP Morgan

High inflation and rising interest rates can create volatile market conditions. This might make staying in cash seem like the safe approach, but taking a risk is more likely to generate a positive return.

According to IG, the median annual return for the FTSE 100, the UK’s leading index, for any 10-year years between 1984 and 2019 was 8.43% (with dividends reinvested). This is a far better rate of return than conventional savings rates.

Moving your surplus cash savings into a well-diversified investment portfolio could be a good option to protect the value of your savings during this period of high inflation.

Remember, though, that investment is a long-term strategy so you’ll need a long-term goal in mind, as well as a firm grasp on your attitude to risk and capacity for loss.

Working with a financial planner to implement your investment strategy, ensuring it is aligned with your risk tolerance, can help you to stay on course for your long-term financial goals.

Get in touch

If you’d like help deciding what the best approach might be for your cash savings and whether investing is ideal for your personal circumstances right now, then please get in touch. Email info@lloydosullivan.co.uk or call 020 8941 9779.

Please note:

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Production

Production