Benjamin Franklin famously said: “In this world nothing can be said to be certain, except death and taxes.”

According to MoneyAge, chancellor Jeremy Hunt’s freeze on UK tax thresholds has led to almost 2 million Brits facing the possibility of paying a 60% marginal Income Tax rate by 2028.

It is one of the latest measures stemming from the new government’s autumn statement and series of policy reversals, following the turmoil of the short-lived Truss administration’s “mini-Budget” in September.

Naturally, if you’ve spent your life working hard and building up a substantial income, you’ll not be excited about the prospect of potentially losing a large chunk to taxes.

But don’t panic! There are ways to build tax relief opportunities into your financial plan and ensure you stay on course to meet your long-term goals and unlock the kind of lifestyle you’ve been working towards.

Read on to discover how pension contributions could be key to protecting your income from potentially high taxes.

The tapering of the Personal Allowance has led to an effective tax rate of 60% for some high earners

If you earn between £100,000 and £125,140 a year, you might end up paying an effective tax rate of 60% due a quirk of the Income Tax rules.

This 60% “tax trap” is a result of the tapering of the Personal Allowance for high earners.

If you earn £100,000 or more, the rate of Income Tax you pay will be affected by the tapering of the Personal Allowance (the amount of income you can earn each tax year without paying Income Tax). This stands at £12,570 for the 2022/23 tax year.

The allowance is currently tapered away at a rate of £1 for every £2 you earn above £100,000.

At the 40% higher rate of Income Tax, there develops a scenario between £100,000 and £125,140 in which the combination of taxes and reduction in allowances leads to an effective tax rate of 60%.

For example, for every £500 of income between £100,000 and £125,140, you only take home £200 — £200 is lost to Income Tax and another £100 is taken away by the tapering of your Personal Allowance.

Over £125,140, you no longer benefit from any Personal Allowance, so you are free from this unusual sinkhole created by the combination of two different tax policies.

If you’d prefer not to pay a tax rate of 60%, there are a few ways you can make up the tax relief elsewhere.

Overcome the effects of the 60% effective tax rate by gaining pension-related tax relief

Paying into a pension scheme is one of the most tax-efficient ways you can save towards your eventual retirement. It can go a long way towards offsetting a potentially hefty Income Tax bill.

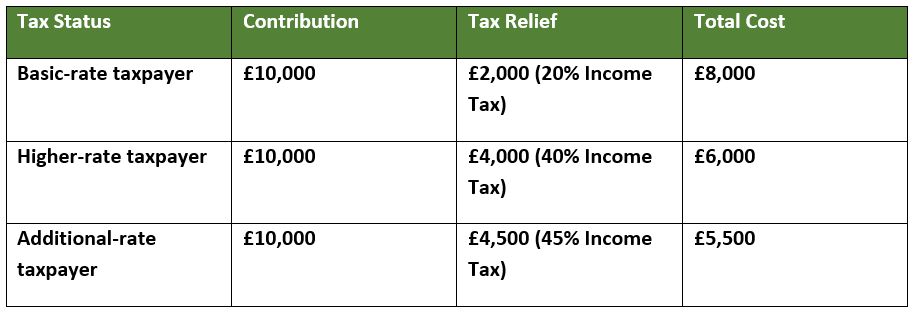

For high earners the benefits of tax relief become even more attractive, as shown by the table below:

Any basic-rate relief is paid automatically, then if you qualify as a higher- or additional-rate taxpayer you can usually claim your further 20% or 25% through your self-assessment tax return.

You can typically save up to £40,000 each tax year into your pension (or 100% of your earnings if lower) and get tax relief from the government.

It should also be noted that your pension can have a whole other range of associated benefits such as the:

- Possibility of “free money” if your employer makes contributions to your workplace pension

- Long-term benefits of compound returns on the value of your pension pot

- Added protection against any potential retirement income shortfall.

It is easy to overlook the vast benefits of utilising your pension scheme to its fullest.

Read more: 7 simple mistakes to avoid when saving for your retirement

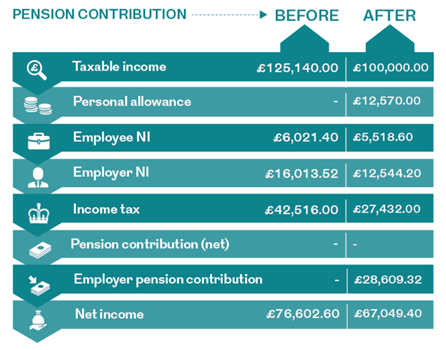

According to Royal London, increasing your pension contributions could help balance out the issues caused by the tapering of the Personal Allowance between £100,000 and £125,140.

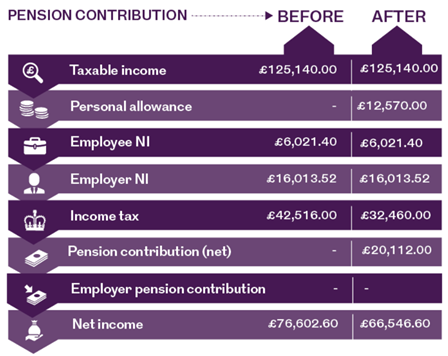

At £125,140, a pension contribution of £25,140 (including the basic-rate tax relief) results in a reduction to net income of just £10,056. This provides an effective tax relief rate of 60% as detailed in the table below.

Source: Royal London

Source: Royal London

Overall, the associated tax relief with pension schemes could be vital in negating any possible issues arising from the “60% tax trap” that can occur for earners between £100,000 and £125,140.

However, before making any major decisions it’s important that you seek professional advice to work out the best strategy for your finances and long-term plans.

Get in touch

Changes in government legislation can change the financial landscape year on year. It is important to remain calm during economic uncertainty and not worry too much about the effects of short-term political events.

A smartly tailored financial plan is designed to protect your wealth and keep you on track to meet your long-term goals. If you are worried about potentially high Income Taxes, please contact us by emailing info@lloydosullivan.co.uk or calling 020 8941 9779.

Please note:

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

Production

Production