The great “saving v investing” dilemma: whether to keep your hard-earned funds safely stored away in a savings account or put them to work generating growth through investing?

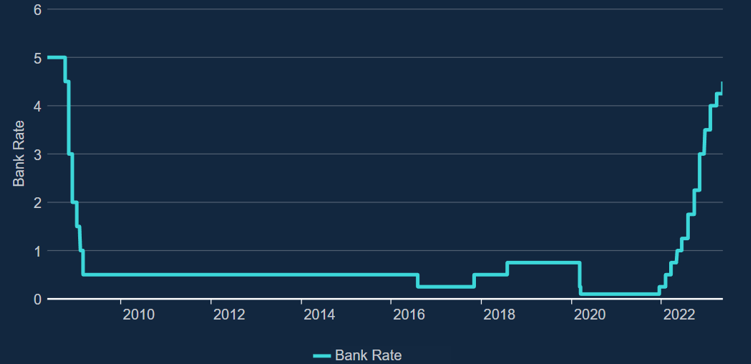

Saving has become an attractive proposition for many individuals in the wake of the Bank of England (BoE) raising the base rate to 4.5% (11 May 2023). The base rate has been on a sharp upwards trajectory since December 2021, after hitting a historic low of 0.1% at the start of the pandemic in March 2020.

Source: BoE

This move has pushed lenders to increase their interest rates. According to MoneySavingExpert, easy-access savings and fixed-term accounts offer best rates of 3.71% and 5% respectively as of 15 May 2023.

In light of the instability of the past few years, sheltering your funds in a savings account with relatively high interest rates might seem appealing.

However, it should be noted that inflation is still high, with the Office for National Statistics (ONS) reporting inflation of 10.1% for the year to March 2023. This could see the “real terms” value of your cash savings eroded over time.

Here are three reasons you might consider investing.

1. Inflation hasn’t fallen as quickly as expected and is having an eroding effect on the “real terms” value of your money

As mentioned, inflation in the UK is still high – approximately double the best interest rates on savings accounts. This can have an eroding effect on the “real terms” value of your funds over time.

For example, if you had £1,000 in a savings account with 5% interest, you’d have £1,050 a year later. However, the cost of £1,000 of goods and services a year ago, factoring in inflation at 10.1%, now cost £1,101. So, the buying power of your money has effectively shrunk over time.

In order to protect the value of your funds from inflation, you’ll likely need to seek out ways to generate growth. One of the simplest ways to do this is through investing.

However, before doing so, you shouldn’t completely ignore the security of your cash savings. It is important to consider setting aside an emergency savings fund before moving any surplus cash into investments.

This fund can provide you with a “rainy day” safety net if any short-term cashflow issues occur in the future. Your emergency fund will ideally cover three to six months’ worth of essential outgoings, such as rent or mortgage payments, utility bills, and groceries.

2. Investing through certain vehicles can be incredibly tax-efficient and save you money

There are many ways to invest your cash and there are pros and cons to each.

One particularly tax-efficient savings vehicle is the Stocks and Shares ISA. You can invest up to the ISA Allowance of £20,000 each year (as of the 2023/24 tax year) and any gains you make are free of both Income Tax and Capital Gains Tax (CGT).

Read more about ISAs in our latest blog, ‘Why it might be better to be an early bird ISA investor’ and decide if it is the right choice for you.

Your pensions are also a very tax-efficient way to invest for your future, so consider diverting some of your excess funds into paying your future self. You won’t be able to access these funds until you reach the minimum retirement age (55 currently but rising to 57 in 2028) but a long-term investment could provide you with added security in later life.

Remember: while there are plenty of positives to consider when opting to invest your funds, there are also added risks.

If your money is invested, there is the possibility for losses as well as gains, so you should only do so if the move suits your personal circumstances and tolerance for risk.

3. Investing could generate the growth needed to keep pace with high inflation

Investing can be a great way to generate growth, helping you stay on course to reach your goals and help you keep pace with high inflation in the short term.

However, the stock market is not for the faint of heart. It ebbs and flows over time, especially during periods of economic instability. It’s important to remain calm and patient.

If you concentrate too much on the short term, you may opt to sell your investments during a market dip — locking in any paper loss as a definitive one — and removing any possibility of your investment bouncing back in the future.

According to Schroders, the FTSE 100 — the UK’s leading stock index — saw returns for investors of 122% with dividends reinvested for the period between 31 December 1999 and 31 December 2019. This is despite the period covering both the dot-com crash and the 2008 global financial crisis.

Meanwhile, IG reports that the FTSE 100 produced average annual returns of 8.43% over any 10-year period between 1984 and 2019.

Investing in the stock market comes with no guarantees. As much as historical data can help offer us insights, it isn’t an indicator of future performance. It is vital that you understand the risks involved and make sure it is the right move for your long-term plans.

Get in touch

If you are tempted by high interest rates on savings accounts or worried about the effects of inflation, taking the time to consider the benefits of investing your funds could be a smart move for your financial plans.

A good first step could be to seek out expert advice by emailing info@lloydosullivan.co.uk or by calling 020 8941 9779.

Please note:

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production