One of the driving factors behind our desire to work and earn money is to provide for our loved ones and unlock a decent standard of living.

The current UK recession, on the back of years of rising inflation, soaring fuel prices, and an increased cost of borrowing, may bring up some reasonable concerns for British households this year.

According to the BBC, the UK economy is expected to shrink by 1.4% in 2023, despite a recent boost from the winter FIFA World Cup.

Read more: What the cost of living crisis means for your financial wellbeing and what you can do about it

Meanwhile the Guardian, reports 30 million Brits could be priced out of a decent standard of living by 2024 as increasing financial pressures shrink the spending power of household budgets.

It is vital to remain calm and remember there are ways you can mitigate the effects of short-term volatility and protect your savings.

Read on to learn about the standard of living crisis many UK households could face and four ways you can protect your wealth to stay on course for your long-term goals.

30 million Brits face being priced out of a decent standard of living by 2024

The New Economics Foundation (NEF), a left-leaning think tank, recently reported that rising prices, wage stagnation, and projected increases in unemployment could result in 43% of UK households being priced out of a decent standard of living.

The NEF forecasts that by 2024 almost 90% of single parents and 50% of workers with children could fall below the minimum income level required to make essential purchases. These include weekly grocery shops, new clothes, and healthcare costs.

The NEF definition of a decent living standard is derived from work by the Joseph Rowntree Foundation (JRF), which researched what people consider to be an acceptable minimum. The JRF’s list of criteria revolves around eight key categories:

- Housing

- Domestic fuel

- Food and drink

- Clothing

- Household goods and services

- Healthcare costs

- Transportation and travel

- Social and cultural participation

Sam Tims, a leading economist at the NEF, said: “A decade of cuts, freezes, caps, and haphazard migration between systems, has left the UK with one of the weakest safety nets among developed countries.”

While the negative effects of the current UK recession and cost of living crisis will be felt more keenly by poorer households, the issues posed by high inflation, wage stagnation, and potential unemployment can affect families from all walks of life.

4 ways you can help protect your wealth and maintain a decent standard of living

1. Ensure you have an emergency fund set aside as a safety net should the worst happen

Periods of instability can lead to a variety of unexpected outcomes. A potentially vital step towards protecting your future, and that of your loved ones, is setting up an emergency fund to cover short-term issues.

This safety net would ideally provide for at least 3 months’ worth of essential bills such as:

- Rent

- Utilities

- Taxes

- Groceries

This step could mitigate short-term cash flow issues and boost your emotional wellbeing with the knowledge that you have emergency funds in place.

2. Review your debt obligations such as mortgage agreements or loans

As interest rates rise, you may see your debt obligations become increasingly unmanageable, especially if you are committed to a variable- or tracker-rate mortgage.

This could see your monthly instalments rise in the short term, putting added pressure on your monthly outgoings.

It may be worth reviewing your obligations and considering whether a switch to a fixed-rate agreement may be beneficial.

3. Consider the benefits of investing your surplus funds

One issue with high inflation is its eroding effect on the “real” value of your wealth when rising costs outpace the best possible interest rates on savings accounts.

Once you’ve established your emergency fund, you might consider investing your surplus funds.

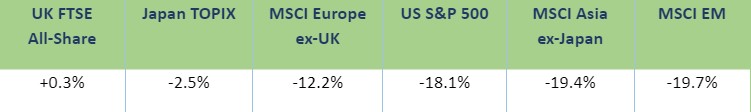

2022 was a volatile year for stock markets around the world. This table shows the performance of some of the world’s leading stock indices for the year, as of 30 December.

Source: JP Morgan

Short-term market volatility can occur, but over the long term, investments can potentially provide inflation-beating returns.

IG reports that the median annual return for the UK’s leading stock index — the FTSE 100 — over any 10-year period between 1984 and 2019 was 8.43% with dividends reinvested.

This means that a smart and patient investment approach — with a well-diversified portfolio aligned to your tolerance for risk — could provide a means to protect your wealth from the worst of high inflation’s eroding effects.

4. Determine whether insurance could provide beneficial cover in the event of an accident, illness, or unemployment

Insurance can provide essential protection should your income stream be cut off, whether through accident, illness, or redundancy.

Recessions typically increase financial pressures on businesses, but insurance cover may be a way to protect your income.

Income protection is a valuable form of cover that typically provides financial support in the event of illness or an inability to work, but can also protect against redundancy.

The cost of cover will likely depend on your health, lifestyle, and the desired length of coverage.

Opting for insurance might be an additional budgetary expense but could also give you some reassuring peace of mind and a valuable safety net should the worst occur.

Get in touch

If you have any concerns about the recession and any potential negative effects on your standard of living, you should consider getting in touch to discuss your plans by emailing info@lloydosullivan.co.uk or calling 020 8941 9779.

Please note:

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Production

Production