As a parent or grandparent, you’ll want the best for your children or grandchildren. It is natural to worry about them and you’ll want to ensure that they are as prepared for life as they can possibly be.

You may find yourself reflecting on your life and the obstacles you had to overcome. As a result, you might decide you want to give your loved ones a step up in life — a financial boost to help them take their first steps out into the big, wide world from a better starting place than you did.

Read on to discover four creative ways you can look out for your children or grandchildren’s futures by planning, saving, and investing on their behalf.

1. Develop a long-term plan that considers their life milestones as well as your own

Your financial plan is likely to be built around your own life milestones.

However, your children or grandchildren are also likely to have their own set of life milestones to prepare for and navigate as they progress into adulthood.

As young adults, they might seek to:

- Attend private education or university

- Take an internship

- Travel the world and gain life experiences

- Purchase their first home

- Get married and have children of their own.

These are rites of passage for many adults, but they also come with their own set of expenses.

As a family, you’ll likely want to have your plans intertwined. This way you are likely to have access to funds to help with your own major life events, as well as potentially support your children or grandchildren with their own.

2. The “Piggy Bank” method — set them up with a savings account with comparably high rates

Your children or grandchildren are likely to have a wide range of expenses in their formative years. Aside from their educational and healthcare needs, they might have groups they wish to join, interests to pursue, or luxuries they badly want to purchase.

Instead of the old-school piggy bank, you might want to set up a children’s savings account in their name, in which you can place regular deposits to support these potential outgoings.

This can help keep requests for money separate from your general budgeting and can teach your children or grandchildren valuable lessons about money management that may benefit them later in life.

Children’s savings accounts can also come with comparably high interest rates compared to adult accounts, with MoneySavingExpert reporting regular saver accounts with rates of 5.5% (as at 17 April 2023).

3. Save early on in their lives to give them a significant boost in adulthood

Saving for your loved ones early in life — even if contributions are relatively small — can help them build healthy savings to support them in the future.

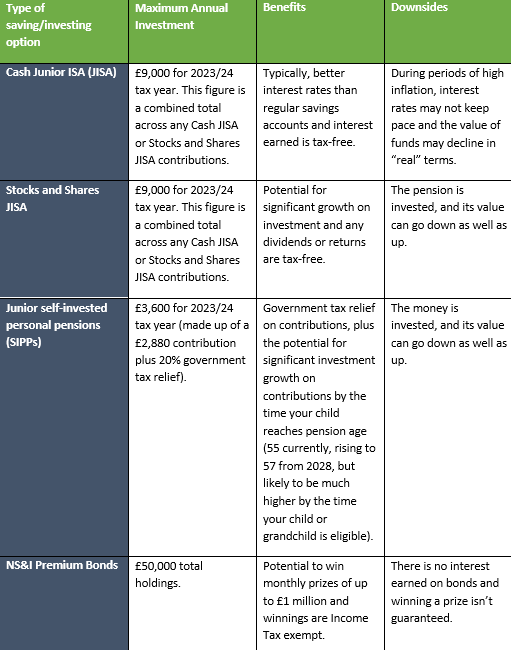

This can be achieved in several ways, all with their own range of benefits, as shown by the table below:

It is important that you assess what it is you are looking to achieve for your child or grandchild and if the level of risk aligns with your profile. A good first step could be working with a financial planner to reassure you that you’re making the right decisions.

4. Gift your wealth to see its benefits to your loved ones while you’re still alive and potentially lower an Inheritance Tax liability

Gifting is an incredibly tax-efficient way to pass on your wealth to your loved ones and see its benefits while you’re still alive. It can provide your loved ones with a significant financial boost, reduce a potential future Inheritance Tax (IHT) liability, and improve your emotional wellbeing as you directly see the improvements to your children or grandchildren’s lives.

Indeed, the notion of “giving while living” is becoming increasingly popular. According to a study in MoneyAge, almost one-third of baby boomers planned to gift money to their adult children in 2022 — a potential wealth transfer of approximately £12 billion.

Gifts include:

- Money

- Luxuries, such as furniture or jewellery

- Property or land

- Stocks and shares.

You have an annual exemption, which allows you to gift up to £3,000 a year (for the 2023/24 tax year) with these gifts falling outside of your estate for IHT purposes. Additionally, the gifts you make will typically fall outside of your estate provided you live for more than seven years after making the gift.

You can also gift to your children or grandchildren by:

- Using the £250 a year small gift allowance (2023/24 tax year)

- Utilising the wedding/civil partnership allowance, which allows for a tax-free gift of £5,000 to your children or £2,500 to grandchildren or great-grandchildren

- Using the normal expenditure from income exemption to make regular payments to cover bills or school fees, for example, as long as you can prove to HMRC that you can afford the cost, it is made from your regular income, and it is given on a regular basis.

Younger generations are expected to inherit more than ever before and could face increasing IHT challenges.

Before making any gifts, speak to us to ensure you’re doing so tax-efficiently. This should help your loved ones avoid a hefty IHT bill.

Get in touch

Preparing for your loved ones’ futures is likely to form a major part of your financial plans. So, it is important that you make the right moves to support them in the long term, while staying aligned with your own objectives and tolerance for risk.

Before making any decisions, you should seek advice by emailing us at info@lloydosullivan.co.uk or by calling 020 8941 9779.

Please note:

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

The Financial Conduct Authority does not regulate NS&I products.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Production

Production