Retirement is the prize you work towards during your working life in the hope of enjoying a relaxing dream lifestyle. Yet, according to the Independent, over half of over-40s feel anxious about whether they’ll be able to cope financially in retirement.

One retirement income option is an annuity, which MoneyWeek reports, have seen rates hit their highest levels since 2007/08. They rose by 44% in 2022.

An annuity is an especially secure and stable way to gain a guaranteed income for life. However, they can be restrictive, and it is important to consider all the pros and cons before opting to purchase one.

Read on to learn what an annuity is, why their rates are so high, and how they could help boost your financial and emotional wellbeing.

An annuity provides a guaranteed retirement income and rates are currently at a 14-year high

An annuity is purchased from a pension provider in return for a stable and regular income, guaranteed for the remainder of your life.

Your annuity income will be determined by several factors, including:

- The size of your accumulated fund

- The annuity basis you choose

- The provider’s annuity rates at the time of purchase.

Annuities have recently been boosted by soaring gilt yields and rising interest rates, which have pushed annuity rates to their highest levels since the 2008 financial crisis.

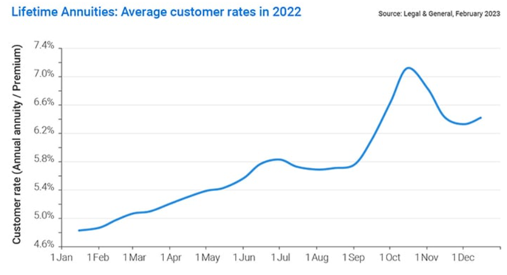

Statistics from Legal & General show that lifetime annuities have seen their average annual rate surge from around 4.8% in January 2022 to nearly 6.4% in February 2023.

Source: Legal & General

The rapid rise in annuity rates have increased the benefits of owning an annuity and have reduced the break-even point — the point at which a buyer would earn back their full initial outlay through received pension income — from almost 21 years to just 15.

4 pros of purchasing an annuity

1. An annuity provides a guaranteed income for life, freeing you up to be more flexible with other pension pots you hold

Once purchased, an annuity pays you a guaranteed income throughout retirement, no matter how long you live. This may mean you end up receiving back more than you originally invested and can go a long way to relieving your retirement income worries.

You could opt to purchase an annuity to give you a stable form of retirement income, while retaining funds in other pension pots to draw on later as you choose.

2. An annuity can be purchased at any time (once you reach the minimum pension age)

There is no requirement to buy an annuity upon retiring. So, you can opt to purchase one later in life when the rate you receive might be higher.

3. Some annuities can provide for your loved ones after you’re gone

It is possible to purchase an annuity with added benefits, such as passing on your guaranteed income to your spouse or civil partner in the event of your death.

4. An annuity isn’t affected by market volatility

Once you use your pension fund to purchase an annuity, your regular income is safe from market fluctuations. Even if there are periods of economic downturn, your annuity will remain stable.

4 cons to buying an annuity

1. An annuity doesn’t offer you a great degree of flexibility

An annuity is inflexible and drawdown might offer greater flexibility in terms of how and when you receive your pension and how much you opt to withdraw. This can make it easier to source funds to pay for big ticket items like a holiday abroad or a new car or home.

2. An annuity counts as taxable income

An annuity is classed as earned income, so it may be taxed. This is dependent on your other earned income, how much you draw from your pension, and how much you’ve used of your Personal Allowance (set at £12,570 for the 2023/24 tax year).

3. An annuity is irreversible, and you can’t change your mind at a later date

Once you’ve purchased an annuity and any cooling-off period has passed, you can’t change your mind and withdraw the funds. It is a permanent decision and one you will need to carefully consider.

4. Once you purchase an annuity, that pension pot is no longer invested

The value of your invested fund can rise and fall but you will be locked into the value of your fund on the day you purchase your annuity.

Rates can vary considerably between providers, so it is important that you shop around and speak to us before making any final decisions.

Get in touch

If you are worried about having financial security throughout retirement, an annuity might go a long way towards relieving those concerns.

If you would like to find out more about how they may factor into your plans, please email us at info@lloydosullivan.co.uk or call 020 8941 9779.

Please note:

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

This article is no substitute for financial advice and should not be treated as such. To determine the best course of action for your individual circumstances, please contact us.

Production

Production