Have you ever wondered exactly how much value you get from working with a financial adviser?

New research suggests financial advice is worth significantly more than people previously thought. This is because financial advice can not only improve your finances but can also boost your health. And that’s something you can’t put a price on.

From your wallet to your wellbeing, read on to discover how a financial adviser can benefit you.

Financial advice can boost your wealth by £47,000

Back in 2019, a study by the International Longevity Centre (ILC) found that people who received financial advice increased their wealth by an extra £47,706 over a decade compared with those who chose to go it alone.

This figure comprised £30,991 of additional pension wealth and £16,715 of additional non-pension assets.

The report also found that people who had an ongoing relationship with their financial adviser generally fared better. People who received advice at both time points in the analysis had nearly 50% higher average pension wealth than those who only received advice at the start.

Financial advice makes people better prepared for retirement

The ILC went on to publish an updated version of its report, looking at the “non-financial” benefits of working with a financial adviser.

Its survey found that people who receive financial advice are more confident about their financial future and better prepared for retirement.

For example, they’re more likely to have spent time thinking about how they will finance their retirement, have milestones in place to ensure they’re on track and have built a diversified portfolio of assets.

In contrast, people who don’t receive advice are generally more uncertain, less clear, and less confident about whether they’ll realise their long-term goals.

Financial advice improves mental wellbeing

The report suggests the benefits of financial advice go well beyond financial gain.

People who received advice described themselves as having:

- Improved financial literacy

- Greater control over their financial future

- Greater reassurance

- A boost in confidence

- More peace of mind.

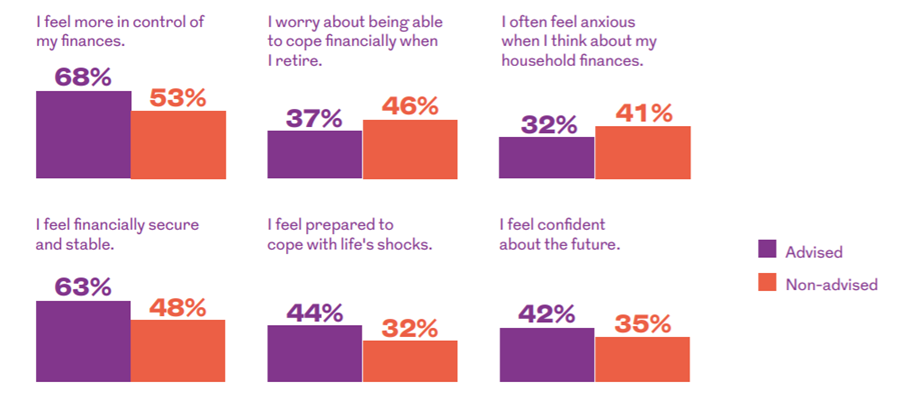

This is backed up by recent research by Royal London, which concluded that financial advice helps to improve people’s emotional wellbeing by making them feel more confident and in control of their financial future.

For example, 63% of people who received advice said they felt financially secure and stable, compared with 48% of those who didn’t receive advice.

Source: Royal London

Money and health are closely linked

The studies build upon previous research demonstrating the close link between financial and mental wellbeing.

A report by the Money and Mental Health Policy Institute shows people in problem debt are significantly more likely to experience mental health problems, and people with mental health problems are more likely to be in problem debt.

The charity’s survey of 5,500 people also found that 86% said their financial situation had made their mental health problems worse. And 72% said their mental health problems had made their financial situation worse.

Financial problems are a common cause of stress – a condition that can cause physical health issues. According to the charity Mind, symptoms of stress range from tiredness and headaches to sleep problems, chest pains, and high blood pressure.

Financial advice provides peace of mind

The peace of mind that working with a financial adviser can bring shouldn’t be underestimated. A financial adviser will spend time getting to know you and your goals, and then come up with a plan that helps turn your dreams into reality.

Some of the ways a financial adviser can provide reassurance include:

- Checking your life, financial, and retirement goals are on track

- Making sure your money is invested the right way

- Protecting you and your family from financial shocks

- Finding ways to preserve and pass on your wealth to loved ones.

Get in touch

At Lloyd O’Sullivan, we’ll help you plan for your future, so you can feel confident your goals are on track. For more information, please email info@lloydosullivan.co.uk or call 020 8941 9779.

Production

Production