During the last few years, global events including the pandemic and the war in Ukraine have contributed to a cost of living crisis that many Britons still face.

A sustained period of high inflation, followed by rising interest rates, has created financial obstacles for families across the UK. One of the most significant is the instability in mortgage and property markets.

According to Reuters, average UK mortgage rates surged to a 15-year high in July 2023, surpassing even the levels following last September’s mini-Budget announcement. The average two-year fixed residential mortgage rate climbed to 6.66%, its highest point since the 2008 global financial crisis.

Meanwhile, the BBC reports that average residential property values have seen their sharpest fall in over 14 years with a dip of nearly 4% in the year to July 2023.

If you’re a homeowner and are still paying off your mortgage, the current economic climate might be putting you under considerable strain. Yet, there are potential solutions to your financial headache.

Read on to learn about four ways to save money on your mortgage in 2023.

1. Review your mortgage agreement and make sure you are on the best rate possible

A good first step could be to review your current mortgage agreement and ensure your existing terms are the best they can be.

According to This is Money, 1.4 million Brits are likely to need to remortgage throughout 2023. Meanwhile, Moneyfacts reports that many homeowners with deals ending in 2023 are currently on fixed-rate mortgages with existing rates below 2%.

If you’re currently tied into a fixed-term agreement, you’re likely to have been protected from the surge in rates over the past year. However, if your agreement is ending soon you could see those terms change significantly.

Remember: if you have benefited from sub-2% mortgage rates, you could see your rate more than triple based on current averages (July 2023).

Taking the time to review your agreement now could help you budget early for any potential changes.

Read more: Remortgaging – The essential steps you should take when your mortgage ends

2. Consider overpaying on your mortgage now to avoid losing money to hefty interest costs over time

One potential way to save on your mortgage over the long term is to overpay now.

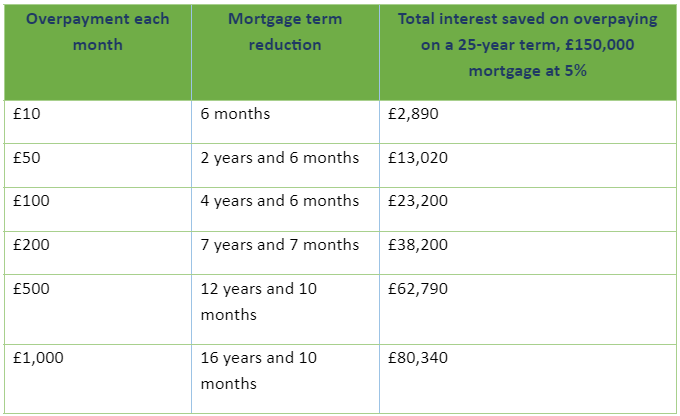

According to MoneySavingExpert, even small increases in your monthly payments could help you save thousands over the long term (savings below are pre-tax and end once the mortgage has been paid off), as shown by the table below:

Source: MoneySavingExpert

If your mortgage exceeds £150,000 or your interest rate is greater than 5% the potential for savings is even greater.

It’s important to remember that overpaying your mortgage could result in early repayment charges (ERCs). These can be costly, so be sure to review your policy’s ERCs and weigh up the potential savings against the cost of charges.

3. Look at whether switching to an interest-only agreement might benefit you in the short term

Sometimes, short-term instability requires short-term solutions.

If you’re struggling with mortgage payments, it could be worth reviewing whether switching to an interest-only agreement – at least in the short term – could alleviate the financial pressure.

An interest-only mortgage means you only pay off the interest on the amount borrowed. This doesn’t decrease the size of your existing debt.

The BBC cites Richard Dana, the chief executive of digital mortgage broker Tembo, who says: “Moving to an interest-only mortgage can keep your monthly payments affordable.

“However, it’s best to use this as a short-term solution, otherwise you will have to pay your remaining mortgage balance at the end of your mortgage term.”

Luckily, despite market instability, the Guardian reports that mortgage approvals are on the rise. So, if you want to opt for a short-term solution before reviewing your long-term options, now might be a good time.

4. Contemplate extending your mortgage agreement over a greater period

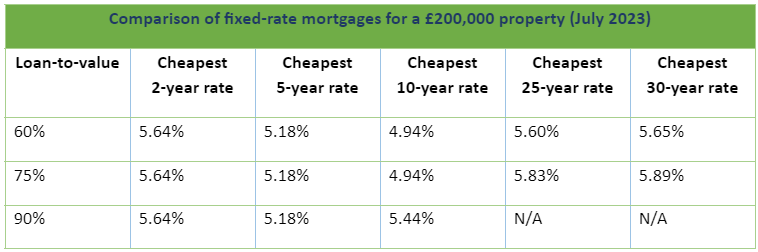

MoneySavingExpert confirms that a 10-year fixed-rate mortgage could be cheaper than a two- or five-year fixed-rate agreement. The report goes on to state that while the trend is that the longer your fixed-rate agreement, the higher the respective rate, this is no longer the case. The recent surge in rates has inverted the curve, as shown by the table below:

Source: MoneySavingExpert

Moneytothemasses reports that the Bank of England’s (BoE) base rate could climb to 5.8% by March 2024, according to some forecasts, possibly prompting further mortgage rate rises.

Opting for a long-term fixed-rate agreement might help insulate you against the possibility of rising mortgage costs.

However, if rates drop significantly over the next decade, you could find yourself facing greater costs.

Discuss your options with us before you decide on the right course of action for you.

Read more: Paying off a mortgage versus investing – Which should you choose?

If your agreement matures this year, it is important to act now – get in touch today

According to the Guardian, mortgages are likely to cost around 1 million Brits an extra £500 each month by 2026. The additional costs could be significant, so it’s important to be proactive and review ways to save money on your mortgage.

A good first step could be to seek out expert advice by emailing info@lloydosullivan.co.uk or by calling 020 8941 9779.

Please note:

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it. Think carefully before securing other debts against your home.

Production

Production