A successful financial plan is built around your individual goals, using carefully calibrated strategies to generate the wealth you need to live your desired lifestyle in retirement.

This is often achieved through long-term investing, using tax-efficient wrappers to achieve risk-managed returns aligned with your goals.

Here are just a few smart ways to invest tax-efficiently:

A private pension could be a great way to save for your future while generating tax-efficient investment returns

Your pensions are likely to form the backbone of your retirement income plans. They are also incredibly tax-efficient.

You can contribute up to £60,000 into your pension (for the 2023/24 tax year) and receive tax relief, thanks to the Annual Allowance. You may also be able to carry forward any unused allowance from the three previous tax years.

Pension contributions automatically benefit from tax relief at the basic rate of 20%. This means that every £100 contribution to your pension only “costs” you £80, with the rest coming from the government.

If you are a higher- or additional-rate taxpayer, you can claim additional tax relief through self-assessment.

The tax benefits of pension contributions can be significant, especially for higher-rate taxpayers who – due to a unique quirk in UK tax law – might be facing an effective 60% rate of Income Tax.

If you want to take advantage of the tax efficiencies pensions offer, while asserting further control over the way your pension funds are managed and invested, you might consider a self-invested personal pension (SIPP).

SIPPs generally offer more flexibility in the investments you can choose. Speak to us now if you think a SIPP might be right for you or if you’d like to discuss the pros and cons.

Investing through an ISA can also be incredibly tax-efficient

ISAs are an incredibly tax-efficient option if you’re looking to grow your wealth.

There are two main types of ISA, a Cash ISA and a Stocks and Shares ISA. Each has its own rules and tax efficiencies. If you are looking to invest in the markets – increasing risk but also the chance of greater returns – a Stocks and Shares ISA could be your best option.

You can pay up to £20,000 each year (2023/24 tax year) into your Stocks and Shares ISA or split your allowance between different types of ISA you hold.

A Stocks and Shares ISA typically invests in company shares, investment funds, or government corporate bonds.

Stocks and Shares ISAs also include several tax benefits including:

- The gains you make on a Stocks and Shares ISA are free of both Capital Gains Tax (CGT) and Income Tax

- There is no Dividend Tax to pay on dividends paid from your ISA investment and they won’t count towards your Dividend Allowance.

You can’t roll over your unused ISA allowance though. It’s vital you take full advantage of it, if you can afford to, before 5 April each year.

Read more: Why it might be better to be an early bird ISA investor

Venture Capital Trusts and the Enterprise Investment Scheme can be especially attractive to higher earners

Venture Capital Trusts (VCTs) and Enterprise Investment Schemes (EIS) are typically seen as higher-risk investment opportunities. They also come with the potential for significant growth.

VCTs are quoted private equity funds traded on the London Stock Exchange (LSE). Meanwhile, the EIS is a government-supported programme designed to help encourage investment in fledgling British companies.

They both typically consist of small, start-up businesses that are seeking investment to achieve further growth. A VCT could contain between 20 and 70 businesses within the fund.

As the businesses that make up VCTs or an EIS-qualifying investment are typically small firms in their infancy, there is a higher possibility for the businesses to collapse. This could lead to a loss on your initial investment.

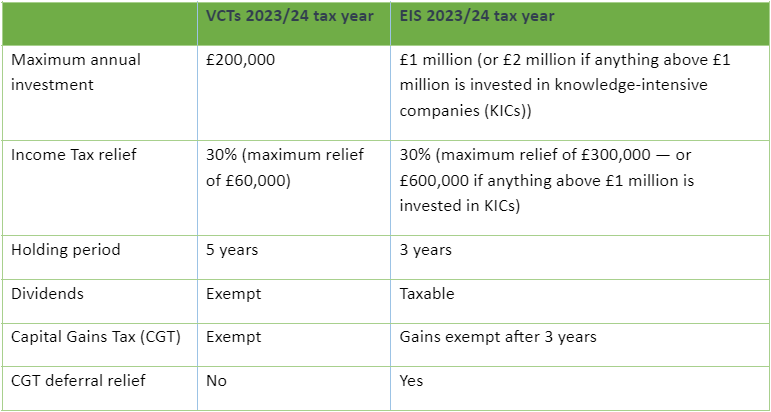

Yet, if the businesses are successful, you could see significant growth over the long term. You could also benefit from tax incentives on any investment, as shown by the table below:

Read more: 3 clever reasons to consider investing your cash even as savings look increasingly attractive

Speak to us for professional financial advice now

Investing is a tricky juggling act of risk and return but it can offer the potential for high returns and be tax-efficient too. Our professional advice can help you navigate any potential issues and pick the right investment option for you, ensuring that you stay on course towards your long-term goals.

If you have any questions, contact us now by email at info@lloydosullivan.co.uk or by calling 020 8941 9779.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Enterprise Initiative Schemes (EIS) and Venture Capital Trusts (VCT) are higher-risk investments. They are typically suitable for UK-resident taxpayers who can tolerate increased levels of risk and are looking to invest for five years or more. Historical or current yields should not be considered a reliable indicator of future returns as they cannot be guaranteed.

Share values and income generated by the investments could go down as well as up, and you may get back less than you originally invested. These investments are highly illiquid, which means investors could find it difficult to, or be unable to, realise their shares at a value that’s close to the value of the underlying assets.

Tax levels and reliefs could change and the availability of tax reliefs will depend on individual circumstances.

Production

Production