In October, interactive investor released its ‘Great British Retirement Survey 2021’. With over 10,000 responses to more than 100 questions, the survey provides a fascinating snapshot of UK retirement in the wake of the coronavirus pandemic.

From where we expect our retirement income to come from, how to keep track of our plans, and changing attitudes to “green” issues, read your guide to the survey results and find out what they have to say about your retirement.

Where will your retirement income come from?

Your pensions

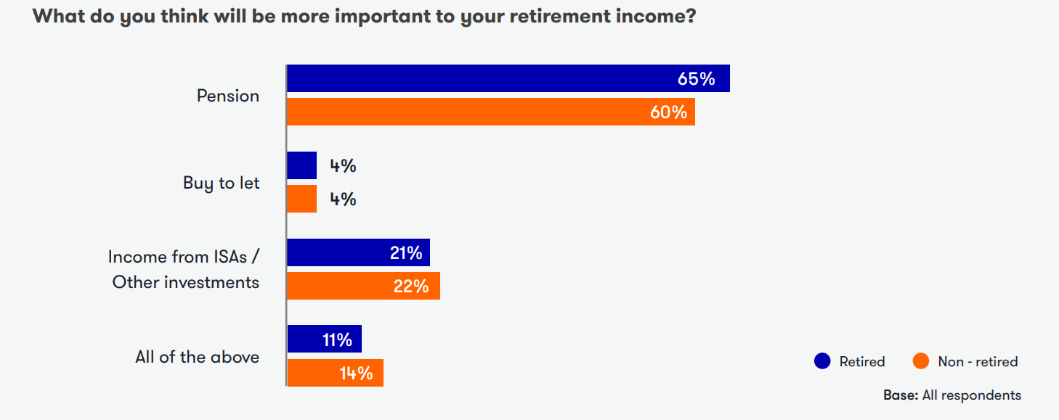

Most of your retirement income will likely come from the pensions you hold. Pensions were deemed the most important source of retirement income for both retired and non-retired respondents to the retirement survey.

Source: Great British Retirement Survey

You might hold funds in a workplace scheme or private pensions, and these could include a mixture of defined contribution (DC) and defined benefit (DB) plans. You’ll also have your State Pension entitlement.

While DC pensions are now the norm for many, DB pensions are often considered the “gold standard”, thanks to the attractive levels of income and the benefits they offer. Understanding how the two can complement each other to provide regular income and flexibility is crucial, so be sure to speak to us as your retirement approaches.

Despite the recent suspension of the triple lock, also be sure not to neglect your State Pension. For the 2021/22 tax year, the full new State Pension is worth 179.60 a week, or £9,339.20 a year. For 2022/23, when the State Pension is due to increase by 3.1% (in line with inflation), these amounts will rise to £185.15 a week and £9,627.80 a year.

We can help you to understand your potential retirement income, from making sure you are contributing enough to your workplace pension to helping you to plug gaps in your National Insurance contributions (NICs).

Other retirement income

According to the Great British Retirement Survey, the next likely source of retirement income is investments.

At Lloyd O’Sullivan, we take a holistic view of your finances. That means accounting for all of the wealth you hold and building a retirement plan that makes the best use of each element.

In the run-up to retirement, this might mean ensuring you optimise your investments through managing risk and making full use of available allowances. Once you retire, we can help to ensure you are drawing your income in the most tax-efficient way.

How many pots do you have? And should you consolidate?

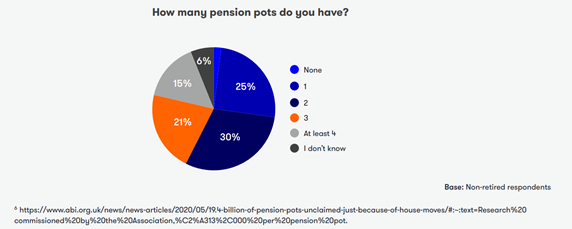

The Great British Retirement Survey found that more than a third (36%) of responders had three or more pensions, while 6% didn’t know how many they had.

Source: Great British Retirement Survey

As the traditional “job for life” becomes increasingly rare, and with auto-enrolment the new norm for many, each career job change could result in a new pension.

Keeping track of these can be difficult, but one option might be consolidation.

The first thing you’ll need to do is dig out your old pension paperwork or use the Pension Tracing Service to find the lost pensions you hold.

Once you know many plans you have, and where they are, you can begin comparing their investment performance and fees to decide whether you’d benefit from moving or combining some.

Putting all your pension funds into one place can be an effective way to lower charges, see improved returns, and make retirement planning easier. But there could be negative consequences too – such as transfer fees or tax implications when taking large sums of money in one go.

Penson mistakes can be costly and far-reaching so be sure to speak to us before you make any big decisions.

What do you want to do in retirement?

Back in April, Royal London looked at what over-55s most wanted to do post-lockdown. Travel was by far the most popular option, with the top three choices being:

- See the Northern Lights (53%)

- Travel on the Orient Express (42%)

- Visit one of the Seven Wonders of the World (36%).

A craving for world travel after the enforced confinement of lockdown is clear in the interactive investor survey responses too, which shows a clear increase in the desire to travel over recent years, either side of the pandemic.

When asked “What does retirement mean to you?”, the response given by 57% of respondents in 2019 was “travelling”. This rose to 67% in 2021.

Understanding what you want to do in later life is a fundamental part of your retirement planning. Once you know what your dream retirement looks like, you can begin to budget for it. This means deciding whether you can afford your dream retirement, and, if you can’t, taking the appropriate actions now to change that.

Get in touch

If you’d like advice on managing your retirement, or any aspect of your financial plans, including your investments, mortgage, or protection plans, please get in touch. Email info@lloydosullivan.co.uk or call 020 8941 9779.

Please don’t hesitate to share this article with your friends and family, or anyone else who you think might benefit.

Please note:

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production